What Vantel users actually want

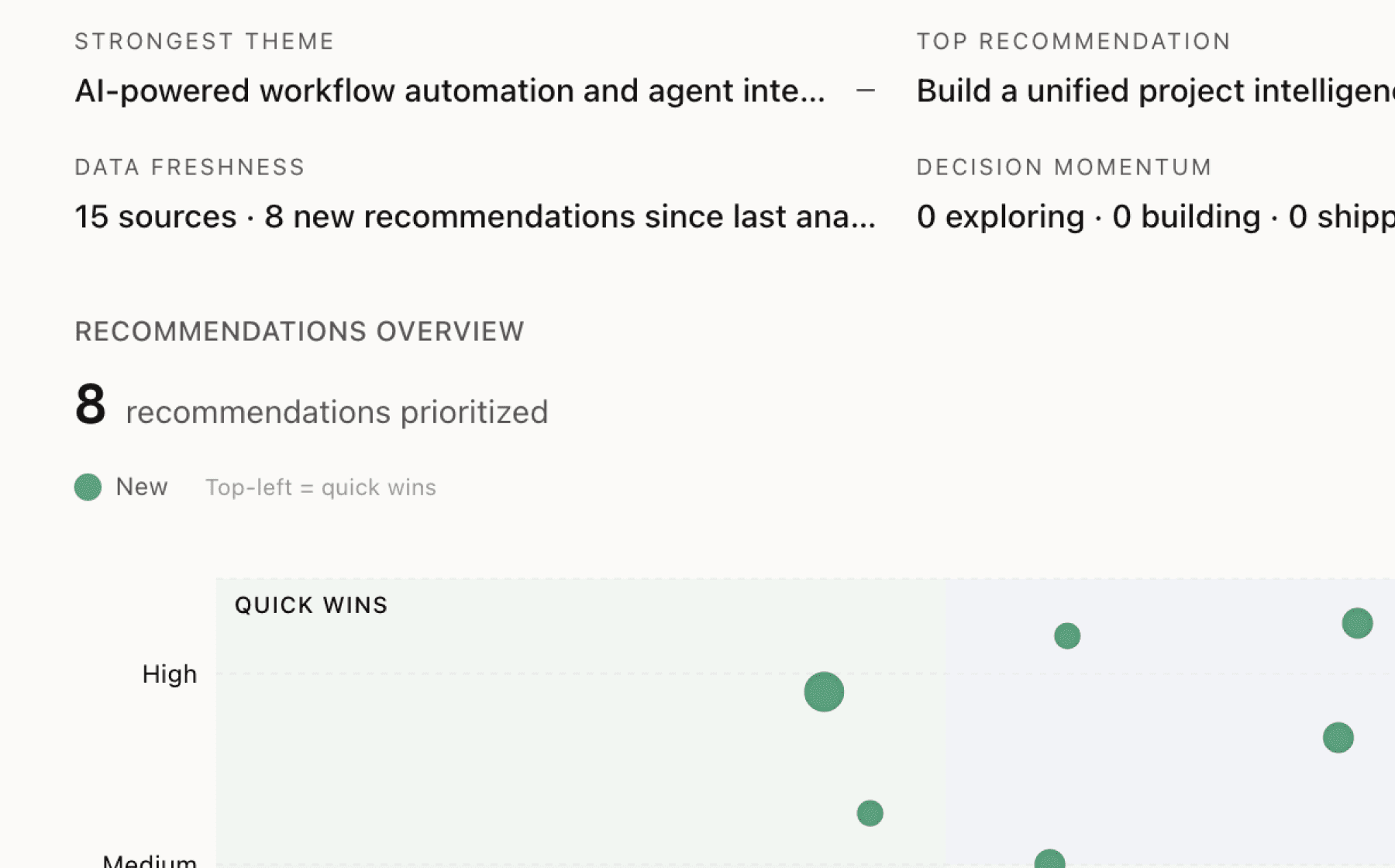

Mimir analyzed 16 public sources — app reviews, Reddit threads, forum posts — and surfaced 14 patterns with 7 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build portfolio-level risk intelligence dashboard showing underinsured clients and coverage gaps across the entire book of business

High impact · Medium effort

Rationale

Brokers currently lack visibility into portfolio-wide risk patterns and cannot proactively identify underinsured clients until renewal or claim events force the issue. The platform already consolidates all policies into one searchable view and reliably detects coverage gaps at the individual policy level, creating the foundation for aggregated risk intelligence.

Scaling gap detection from individual policies to portfolio analysis transforms reactive coverage review into proactive client management. Brokers could identify all clients missing cyber coverage, spot patterns in exclusion trends across carriers, and prioritize outreach based on exposure severity rather than renewal timing.

This directly addresses the 30+ hours of manual work limiting advisory capacity by surfacing high-value opportunities that would otherwise remain buried in scattered policy files. Portfolio intelligence enables brokers to lead with insight rather than respond to client requests, fundamentally changing the value proposition of the relationship.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

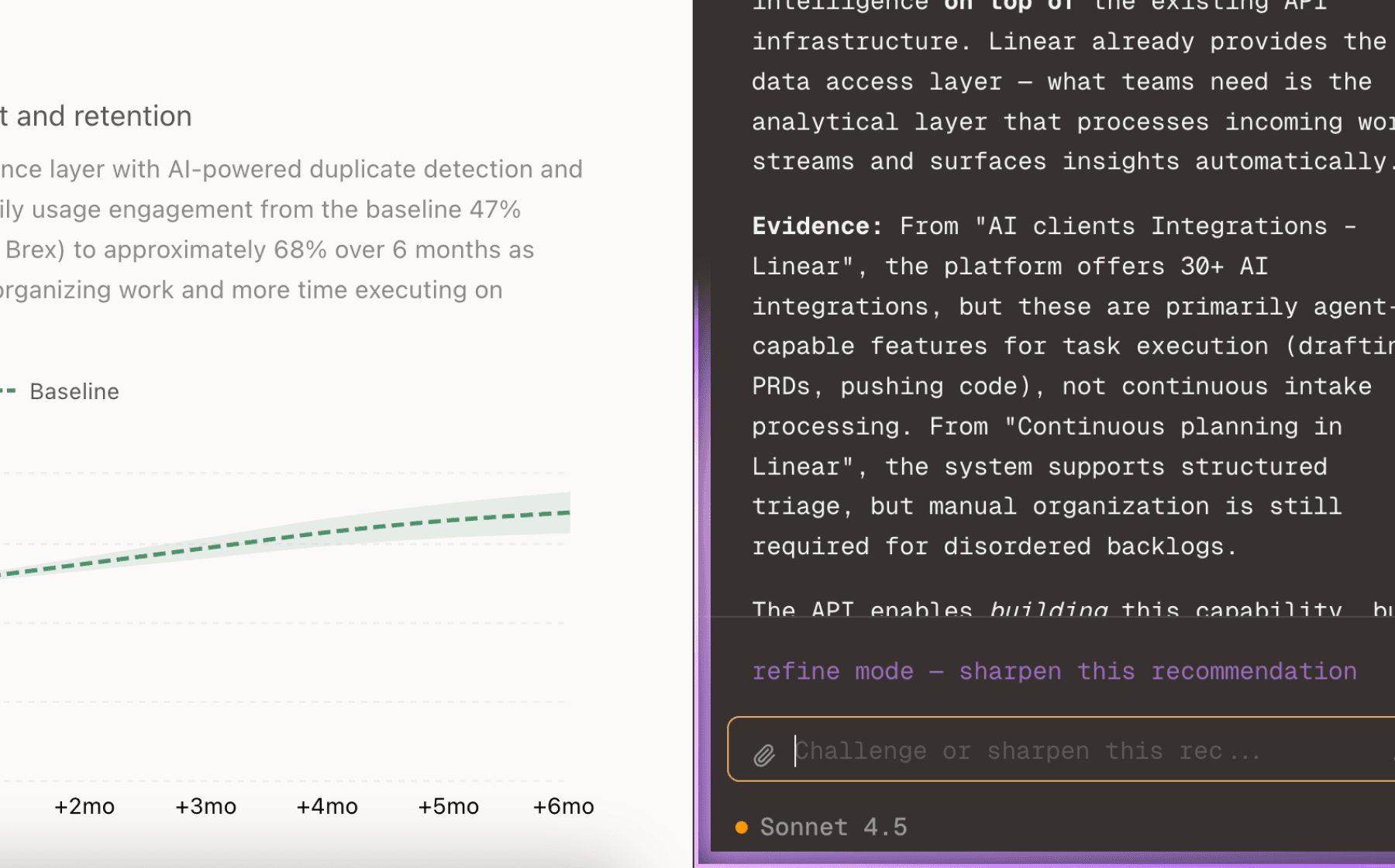

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

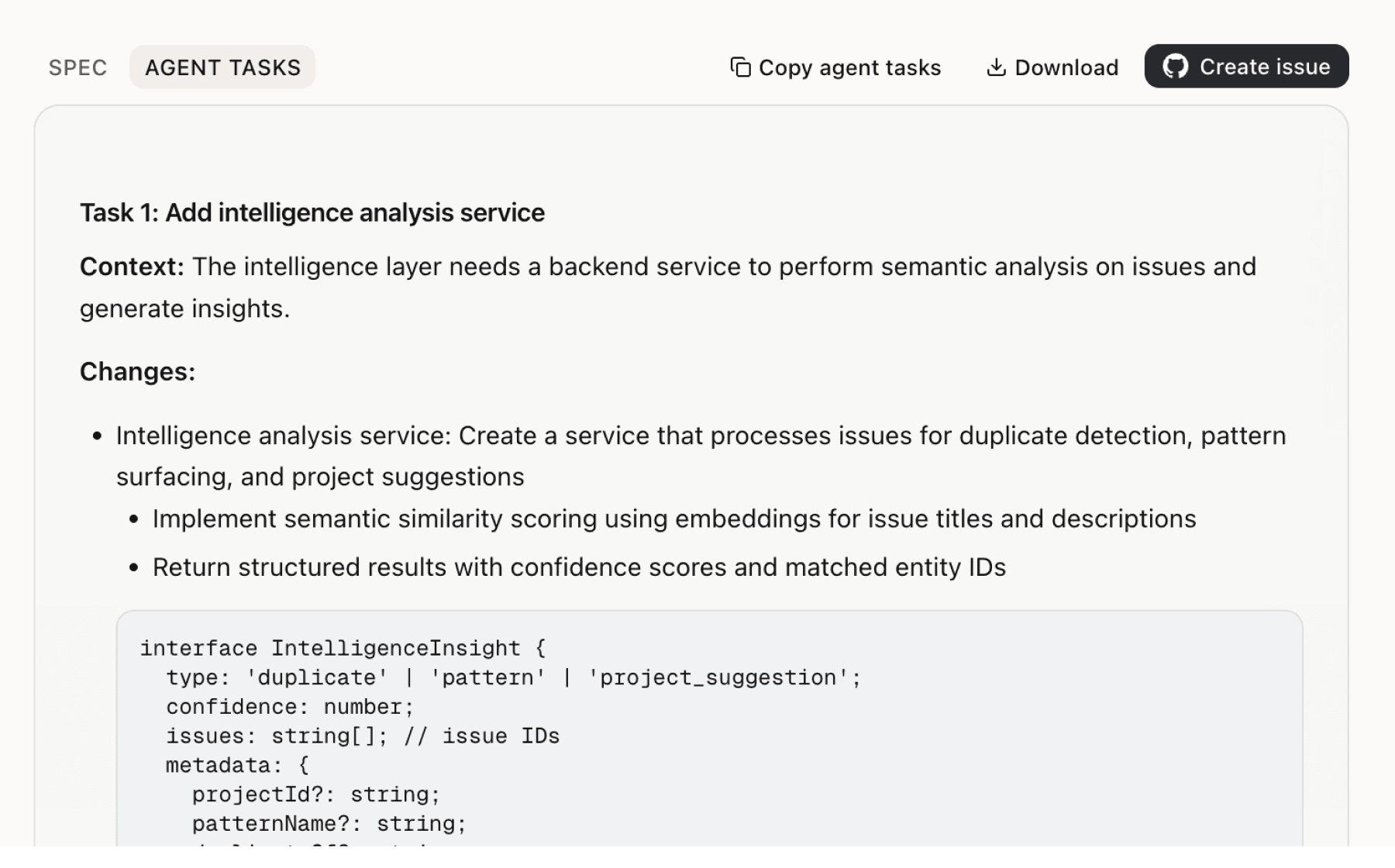

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

6 additional recommendations generated from the same analysis

Brokers can now verify where data originated, but they cannot see how endorsements override base policy terms or understand the structural relationships that determine actual coverage. Generic AI tools fail precisely because they treat policies as narrative text rather than structured documents with defined hierarchies between definitions, exclusions, conditions, and endorsements.

The platform tackles multiple high-friction workflows but the generalized positioning masks which specific use case delivers fastest ROI for different broker personas. Successful AI adoption requires narrowing aggressively to one high-volume, high-friction workflow with clear metrics and short decision horizons.

Brokers who try Microsoft Copilot or ChatGPT for policy analysis often conclude that AI doesn't work for insurance, creating a perception barrier that blocks evaluation of purpose-built solutions. The Copilot article articulates specific failure modes with clinical precision, but prospects need to experience the difference rather than read about it.

Brokers generate client-ready summaries and recommendations in one click, but these outputs remain internal tools for broker decision-making rather than deliverables that accelerate client approvals. The 2x speed improvement in client approvals suggests bottlenecks remain in translating broker insights into client-facing materials.

Unmanaged shadow AI usage is growing across broker teams, creating data privacy, compliance, and liability exposure that IT leaders recognize but cannot quantify or control. Brokers upload sensitive policy documents to ChatGPT or Copilot because the friction of approved tools exceeds the perceived risk.

Brokers spend significant time configuring comparison views and defining which fields matter for their specific carriers and coverage lines. While the platform automatically extracts limits, exclusions, and conditions, new users must still determine how to structure comparisons for Property versus GL versus Cyber policies.

Insights

Themes and patterns synthesized from customer feedback

Vantel has launched multiple features (Interactive Highlighting, Quote Comparison, Portfolio Intelligence) and established strategic partnerships (Brokerslink) to expand reach and serve a global network of independent brokers. Recent seed funding validates market opportunity and supports scaling the platform.

“Angel investors include founders and AI experts with experience at Spotify, Airbnb, Revolut, Adyen, and Brex, plus insurance insiders from Lloyds of London and Anthropic”

Product roadmap is guided by feedback from top US brokers, emphasizing collaborative development to ensure alignment with real-world workflows. This broker-led approach to product decisions builds trust and ensures features address genuine pain points.

“Vantel's product development is guided by feedback from best brokers in the US who help shape the roadmap”

Vantel is actively hiring for core technical roles including Founding Engineer positions, indicating an expansion phase to scale product development and deliver on roadmap commitments.

“Actively hiring for Founding Engineer role in Stockholm, indicating expansion phase and need for core technical talent.”

Users report significant improvements in client support capacity, policy analysis accuracy, and quote comparison speed with time savings and team capacity expansion. Customer testimonials and case studies demonstrate real-world value and positioning as setting new best practices for broker-AI workflows.

“We have Vantel for proofreading policies and comparing quotes. This has been a true time saver and game changer for our agency!”

Policy files and carrier documents are scattered across systems, requiring manual chasing and comparison that prevents portfolio-level insights. The platform consolidates all policies into one searchable, structured view, transforming unstructured documents into institutional knowledge assets and enabling proactive client management.

“Generate client-ready summaries and policy recommendations with source-linked highlights in one click”

Brokerages require strict data segregation, encryption, and compliance with regulatory frameworks to handle sensitive client and policy information. The platform implements AES-256 encryption, role-based access, MFA, environment isolation, GDPR and HIPAA compliance, enabling adoption by large commercial brokerages.

“Each brokerage's data is segregated into dedicated environments to eliminate crossover risk or accidental exposure.”

Brokers need to generate policy summaries, recommendations, and coverage comparisons with source-linked highlights efficiently to support faster client decision-making. One-click generation of client-ready outputs reduces time-to-insight and enables more confident recommendations in the approval process.

“Generate client-ready summaries and policy recommendations with source-linked highlights in one click”

Successful adoption requires targeting high-friction, high-volume workflows with clear metrics and alignment between IT success metrics (speed, accuracy) and business outcomes (placement ratios, retention, revenue). Pragmatic implementation around legacy systems unlocks incremental value and drives engagement.

“"AI can fundamentally change how brokers work, but only if it is built around real workflows, not abstract promises"”

Brokers need to maintain decision-making authority while gaining instant structured data to support judgment. The platform empowers rather than replaces broker expertise through verifiable insights with audit trails and traceable source evidence for liability protection.

“Brokers need to stay in control of client decisions while having instant context and structured data to support their judgment”

Brokers need AI technology tools to stay differentiated from competitors and maintain their advisory value proposition in the market. Vantel's tools enable brokerages to serve clients more effectively at scale while avoiding the compliance risks of shadow AI adoption.

“Insurance brokers need technology tools that will keep them differentiated from competitors. Vantel is a great AI technology solution that is constantly improving and tuning their tools to maximize...”

Brokers manually flip between multiple tabs and documents to compare coverage across insurers, a time-consuming and error-prone process. The platform enables side-by-side comparison with gaps and differences surfaced automatically, reducing comparison time and improving accuracy.

“Enable side-by-side comparison of coverage across multiple insurers with gaps and differences surfaced automatically”

Brokers spend 30+ hours weekly on routine document extraction, comparison, and manual policy review instead of high-value advisory work and client relationships. This labor-intensive bottleneck directly limits user engagement by reducing capacity for strategic interactions and new business development.

“Insurance knowledge and critical policy details sit trapped in unstructured files (PDFs, emails, documents), requiring manual extraction and comparison work”

Brokers fear AI hallucination and cannot verify extracted data against source documents, creating liability concerns and preventing adoption. Generic tools like Copilot lack insurance-domain reasoning and fail to understand policy structure, while purpose-built insurance AI with click-to-source verification addresses these concerns.

“Brokers fear AI reliability: 'How do I know this is right?' Unable to verify AI-extracted data against source documents creates liability risk.”

Brokers struggle to reliably identify coverage gaps, exclusions, and policy changes during manual review, creating liability risk and missed client protection. The platform surfaces these gaps automatically, directly improving policy analysis accuracy and client risk protection.

“Brokerages lack visibility into underinsured clients and cannot identify coverage gaps across their book of business”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.