What SpotPay users actually want

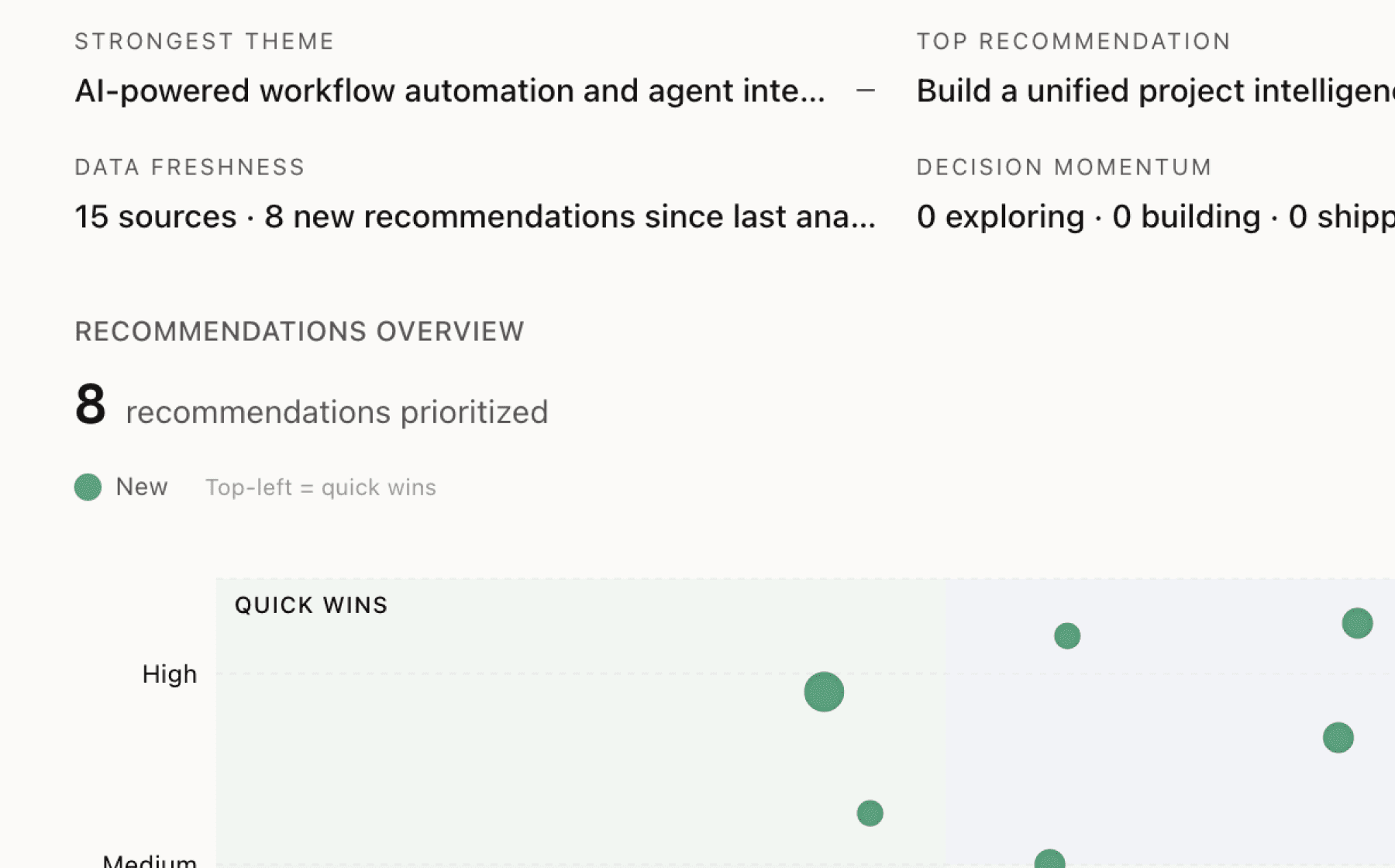

Mimir analyzed 1 public source — app reviews, Reddit threads, forum posts — and surfaced 4 patterns with 6 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build a cross-border money movement showcase into onboarding that demonstrates instant transfer value within the first session

High impact · Medium effort

Rationale

The product's core differentiator is instant global money movement, yet users must discover this value themselves after setup. With adoption as a priority metric and account setup already optimized for speed, the critical gap is connecting fast onboarding to immediate value demonstration. Users who experience the primary benefit early show higher retention and engagement.

The evidence shows SpotPay positions instant transfers and global reach as key differentiators, but rapid account activation alone doesn't guarantee users understand or experience these capabilities. A showcase flow that guides users through a simulated or real first transfer during onboarding converts setup velocity into feature comprehension and early habit formation.

This directly addresses adoption by reducing time-to-value and establishing the primary use case before users abandon the app. The security infrastructure and regulatory compliance already support this capability, so the effort centers on onboarding experience design rather than building new financial rails.

Projected impact

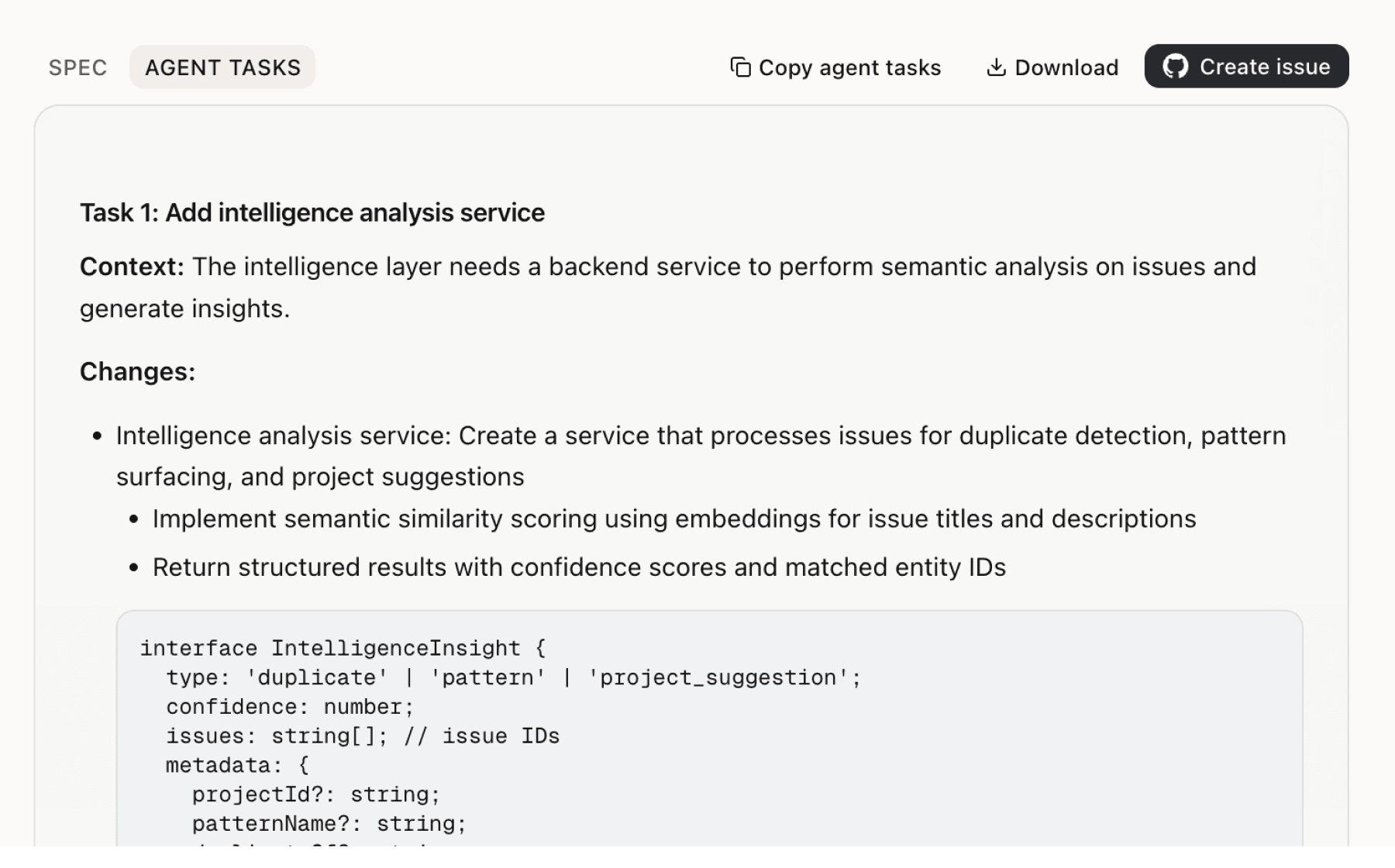

Implementation spec

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

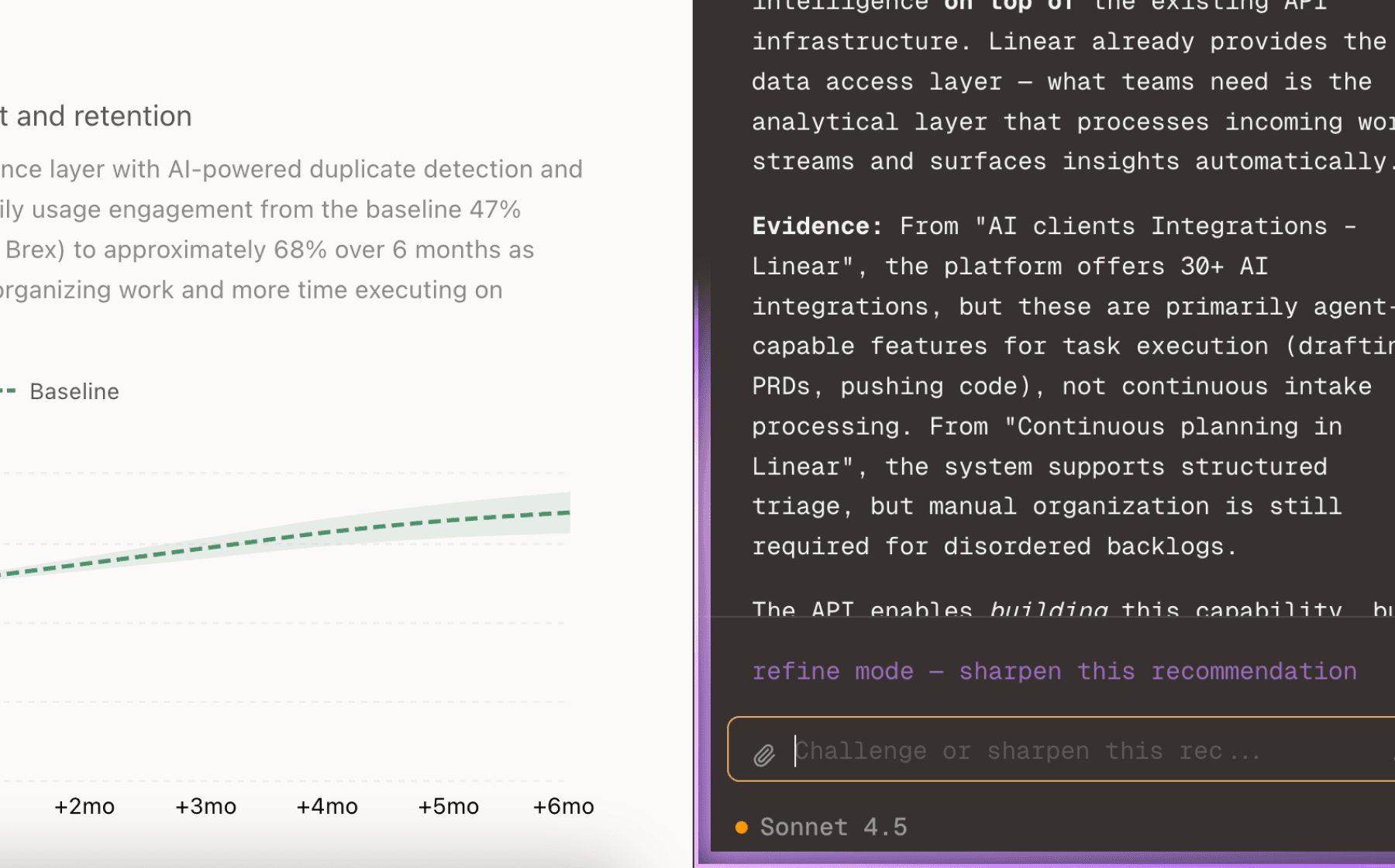

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

5 additional recommendations generated from the same analysis

SpotPay offers four distinct money management functions, but the evidence suggests these operate as separate features rather than an integrated experience. Users managing money comprehensively need to see the full picture of their financial activity, not navigate between isolated views for sending, spending, and saving.

SpotPay emphasizes transparent fees for international transfers as part of its value proposition, but transparency only creates competitive advantage if users can compare costs before choosing a provider. Cross-border remittance is a high-friction, trust-sensitive category where users evaluate multiple options. Showing cost savings proactively converts transparency into a conversion tool.

The evidence indicates SpotPay offers send, spend, and save functions explicitly, with grow capabilities implied but not detailed. Without visible growth features, SpotPay risks commoditization as a basic payment app competing solely on transfer speed and fees. Users managing money comprehensively expect tools that help them understand and optimize their financial behavior.

The Calypso Card enables worldwide spending using wallet balance, but card activation is typically a passive utility setup rather than a value demonstration moment. Users who understand they can spend their SpotPay balance anywhere internationally are more likely to fund their wallet and use the card regularly, directly supporting both adoption and transaction volume.

SpotPay operates as a registered Money Services Business with industry-standard security measures, but this institutional credibility may not translate into user confidence during the vulnerable first transaction. Users sending money, especially internationally, need reassurance that their funds are protected and the platform is legitimate.

Insights

Themes and patterns synthesized from customer feedback

SpotPay delivers four core money management functions through integrated features: send/receive (locally and internationally with transparent fees), spend (via Calypso Card for online and in-store worldwide), save (digital wallet with real-time balance visibility), and implied growth capabilities. This aligns with the stated product mission to enable users to manage money comprehensively in one app.

“send/receive money locally and internationally, hold funds in digital wallet, and spend globally with Calypso Card”

SpotPay implements industry-standard security measures (encryption, secure authentication, real-time monitoring) and operates as a registered Money Services Business with FinCEN, establishing trust and compliance as foundational to the platform. These controls enable safe fund management across borders and support consumer confidence in adoption.

“Security features include industry-standard encryption, secure authentication, real-time monitoring, and transparent fund controls”

SpotPay prioritizes low-friction account creation and guided onboarding, positioning account setup in minutes as a competitive advantage. This approach directly supports the adoption priority by removing setup barriers and enabling users to quickly access core functionality.

“account setup in minutes with guided onboarding”

SpotPay's primary differentiator is enabling users to send, receive, hold, and spend money globally from a single app without friction. The product emphasizes speed (instant transfers), global reach (cross-border and worldwide spending), and simplicity (account setup in minutes) as competitive advantages that directly support the core mission of providing access to modern financial tools.

“Everything you need to manage your money—One powerful app that lets you hold funds, move money instantly, and spend anywhere—without complexity”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.