What Rally users actually want

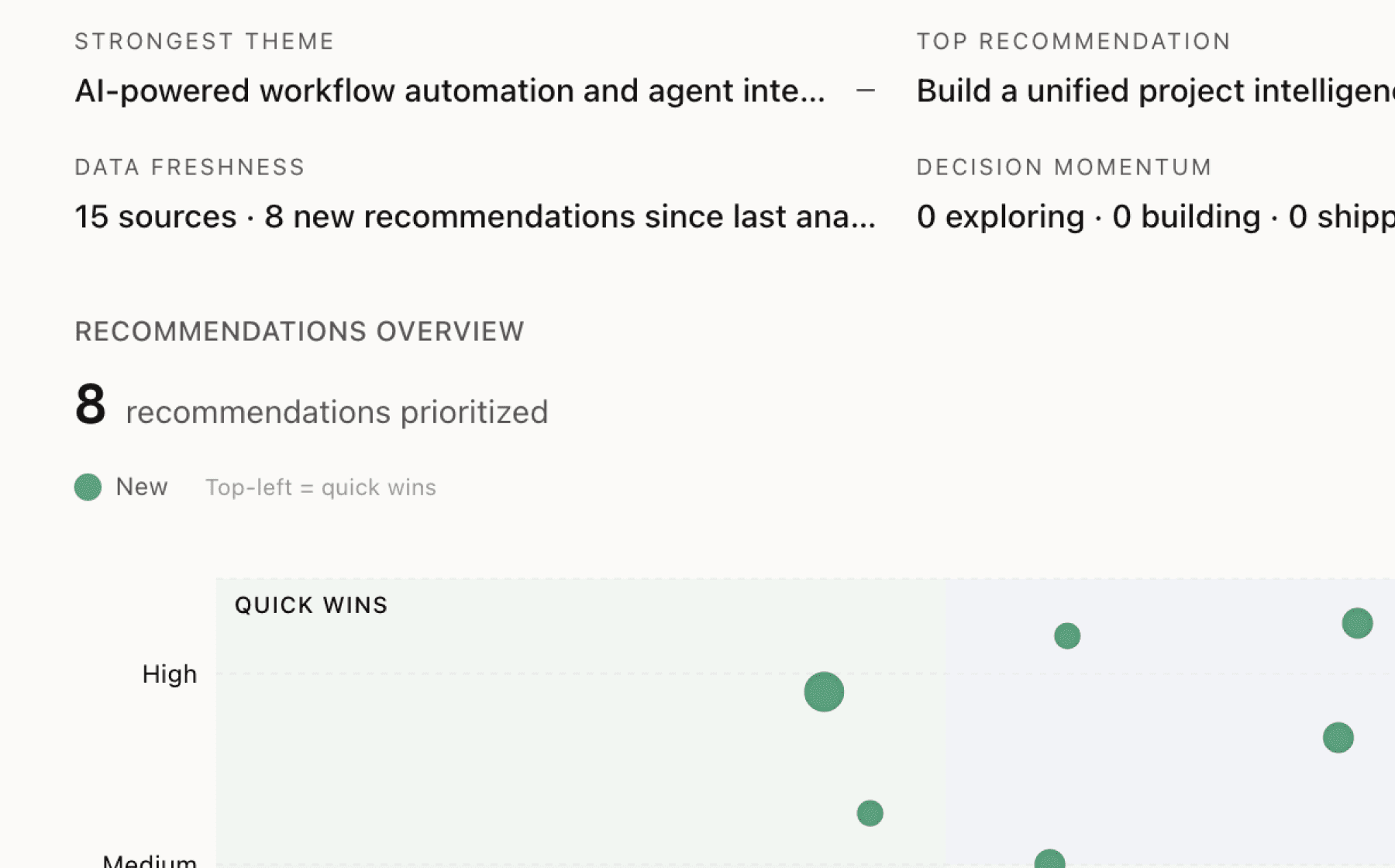

Mimir analyzed 15 public sources — app reviews, Reddit threads, forum posts — and surfaced 15 patterns with 8 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build interactive ROI calculator showing personalized savings vs. current provider on homepage

High impact · Medium effort

Rationale

Cost savings is the primary acquisition driver but currently relies on static claims (10% savings, 18 hours saved). Users need to see their specific savings upfront to overcome switching inertia. Twenty-two sources confirm transparent pricing elimination of hidden fees as the core value proposition, yet the website requires users to trust generic numbers rather than calculating their specific scenario.

An interactive calculator that takes current provider, fleet size, and monthly spend would translate Rally's value proposition into concrete dollars and hours for each prospect. This directly addresses the open question of engagement by creating an immediate value anchor. Users who see their personalized savings (e.g., "Save $2,400/month switching from Shell") are more likely to complete demo requests and convert.

The calculator also creates a natural segue into the demo flow by capturing lead information (current spend, provider) that sales can reference. This bridges the gap between marketing claims and personalized value demonstration.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

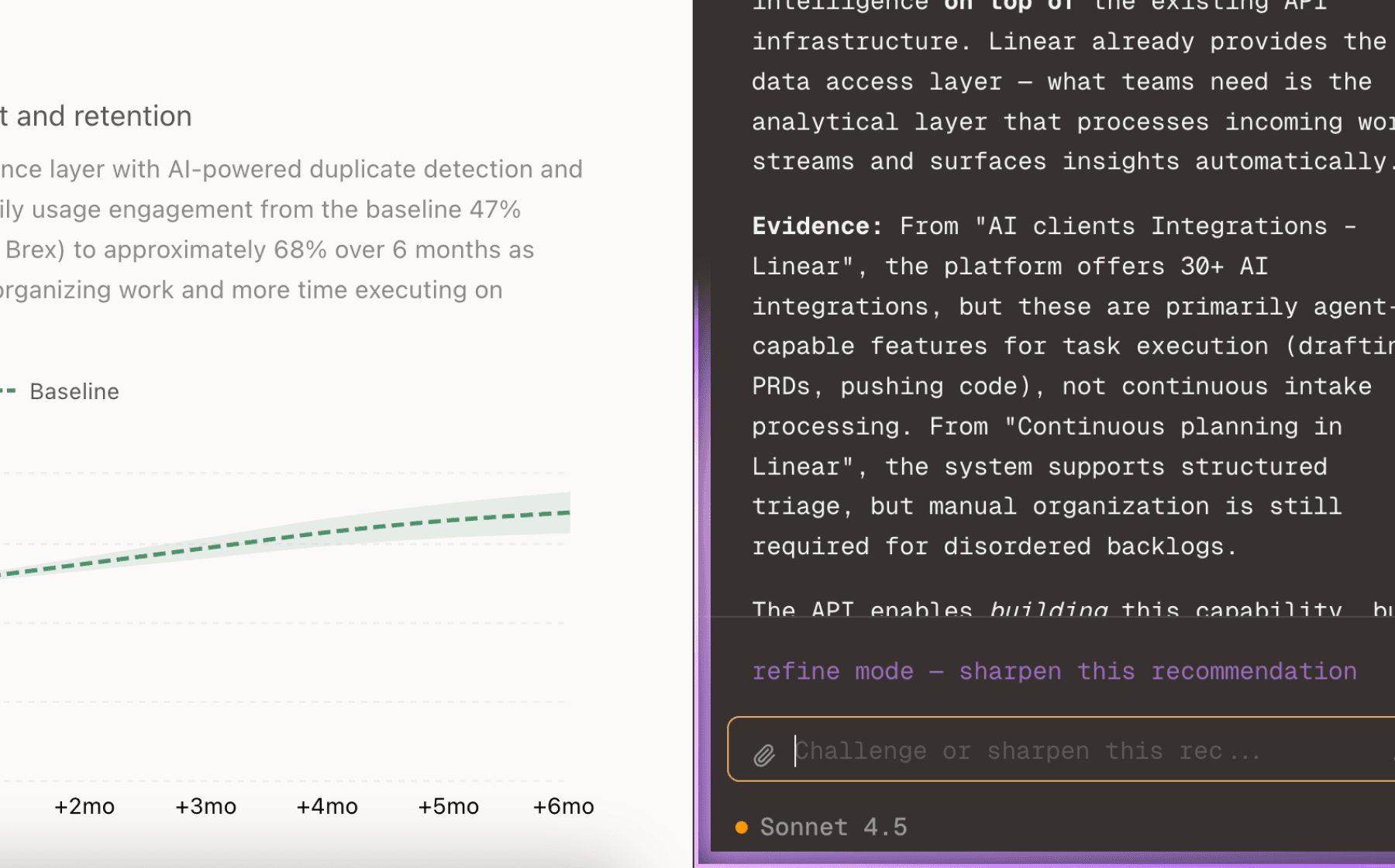

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

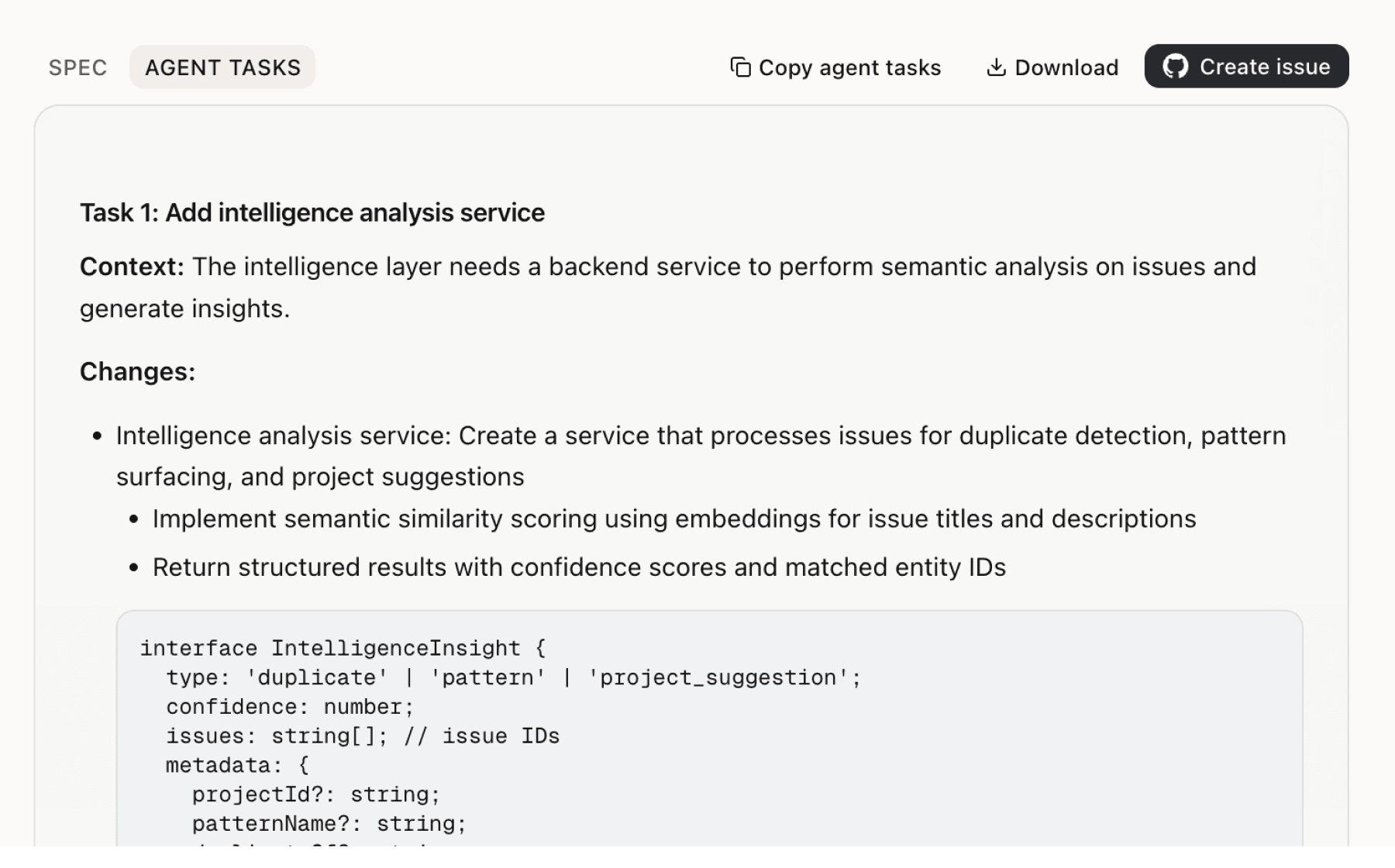

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

7 additional recommendations generated from the same analysis

Form submission failures are blocking prospects at the highest-intent moment in the funnel. Ten sources document Cloudflare Turnstile verification failures, expirations, and error states on both contact and demo pages. Every failed form submission is a lost lead when the user has already decided to engage.

Users sign up for cost savings but experience value through time savings. The 18-20 hours of monthly automation savings only materialize after users have configured cards, connected accounting systems, and accumulated transaction history. The gap between signup and first value realization creates churn risk during the critical early engagement window.

Real-time fraud detection and AI-powered alerts are positioned as key features across nine sources, but these capabilities remain invisible until actual fraud occurs. Users evaluating Rally during a trial period may never encounter suspicious activity, leaving this entire value pillar undemonstrated. The platform's ability to block unauthorized expenses and send instant alerts only becomes tangible when something goes wrong.

Nine sources show Rally investing heavily in competitive comparison content (Shell alternatives, BP alternatives, UTA alternatives), but the website doesn't streamline the actual switching process. Users convinced by comparison content still face migration friction. Moving transaction history, reconfiguring policies, and transitioning drivers creates inertia that keeps users with incumbent providers despite Rally's advantages.

Rally positions 24/7 support with minute-level response times as a retention differentiator across eight sources, contrasting with competitors' week-long turnarounds. However, this claim remains abstract until users need support. Making response time a visible, measurable part of the user experience would strengthen trust and validate the service promise proactively.

Access to 1,000,000+ fuel and charging points is cited across seven sources as a key differentiator, but this network advantage remains abstract. Users don't experience the benefit of broad coverage until they encounter location limitations with competing cards. A visual map showing station density along routes their fleet actually travels would make this abstract number tangible during evaluation.

Six sources highlight accounting integration and automated reporting as core capabilities, but integration setup often creates activation friction. Finance teams need Rally data flowing into their existing systems (Xero, QuickBooks, SAP) to realize the 18-20 hour time savings, but configuring these connections requires technical knowledge and time investment that delays value realization.

Insights

Themes and patterns synthesized from customer feedback

Rally maintains multilingual support and localized content across UK, France, Germany, Spain, and Italy with regional compliance (GDPR, SOC2, ISO 27001) and market-specific guides. This geographic expansion strategy addresses localization friction and positions Rally for broader European user acquisition.

“Rally maintains multilingual website presence across English, Spanish, German, and French with localized content for each region”

Rally publishes diverse content (Research & Insights, Customer Stories, Product Updates, Sustainability) and runs competitive comparison campaigns against traditional fuel card providers (Shell, BP, UTA, Esso). Customer success stories demonstrating tangible savings support acquisition and user engagement.

“Rally publishes blog content across multiple categories: Research & Insights, Customer Stories, Product Updates, Sustainability, and Regulations”

Rally serves distinct user personas (business owners, fleet managers, finance teams, drivers) with role-specific features tailored to their decision-making authority and operational needs. Segmenting by role (CEO, CFO, Finance Manager, Fleet Manager, Operations Manager) enables targeted value propositions that improve adoption and engagement across organizational levels.

“Rally serves multiple user personas: business owners, fleet managers, finance teams, and drivers with role-specific features.”

Rally positions itself as a Financial OS for modern fleet management covering fuel cards, EV charging (Rally Charge launched Jan 2026), and unified expense management. Y Combinator backing and demonstrated customer success (Huel, Autohero) validate market fit and product-market alignment.

“Core product positioning centers on fleet spend management, fuel cards, EV charging, and expense management for European fleets”

Rally supports up to 10 users in a single account workspace, enabling team collaboration for distributed fleet management and financial operations across multiple organizational roles.

“Support for up to 10 users in a single account/workspace”

Cloudflare Turnstile verification failures and form submission errors on contact and demo pages create friction in the conversion funnel. These technical barriers block prospective users during critical engagement moments and directly impact lead generation and user conversion metrics.

“Demo request CTA prominently featured alongside contact form to reduce friction for prospective users”

Fleet managers struggle managing multiple portals for different expense types (fuel, tolls, maintenance, parking, EV charging). Rally's all-in-one dashboard with real-time tracking, analytics, and fraud detection across all expense categories directly improves engagement by eliminating navigation friction.

“Rally targets small businesses and enterprise fleets with content on fuel management systems, EV chargers, and cost optimization”

Users require granular spending limits, real-time fraud detection, transaction blocking, and immediate alerts to prevent unauthorized expenses. Rally enables customizable controls by driver, vehicle, or category with AI-powered fraud detection, addressing critical governance and security concerns for financial management engagement.

“Customizable spending limits by driver or vehicle with granular policy controls”

Rally emphasizes 24/7 support with minute-level response times versus competitors' week-long turnarounds. This responsiveness directly supports retention by resolving user issues quickly and builds trust in platform reliability.

“24/7 customer support positioning emphasizes speed (minutes, not weeks) as competitive advantage”

Access to 1,000,000+ fuel, charging, and service points across Europe provides broad network coverage that reduces payment friction for drivers and differentiates Rally from competitors with limited location availability. This network scale supports driver convenience and engagement.

“Access to 1,000,000+ fueling, charging, and service locations integrated into platform”

Finance teams need seamless integration with accounting software for instant synchronization and real-time expense tracking without manual reconciliation. Rally's automated reporting and AI-powered receipt categorization reduce accounting team workload and enable faster financial visibility.

“AI-powered receipt reading and automatic expense categorization”

Rally's DriverLink WhatsApp integration enables drivers to submit receipts with AI-powered automatic categorization, meeting drivers where they already communicate. This reduces friction in expense management by eliminating separate app switching and manual data entry.

“DriverLink WhatsApp integration for fuel card management launched August 2025, enabling modern communication channel for fleet drivers”

Rally's primary value proposition centers on delivering 10% cost savings and eliminating hidden fees (20% markups found with traditional cards). Transparent, predictable pricing without surprise surcharges is consistently positioned as the key competitive differentiator that drives user acquisition and retention.

“Unexpected fees like 20% surcharge for low usage on traditional fuel cards”

The platform delivers quantifiable time savings (18-20 hours monthly) through automated expense categorization, receipt processing, and invoice reconciliation, replacing manual Excel-based workflows. This automation directly supports user retention by demonstrating measurable ongoing value.

“Average time saved each month on admin and accounting work”

Users experience friction from card rejections at terminals and lack of real-time visibility into transaction approvals. Rally's 100% Visa network acceptance with instant physical and virtual card issuance, combined with real-time transaction tracking, addresses this critical pain point that impacts driver experience and platform trust.

“Drivers experience card rejections at payment terminals due to legacy fleet card limitations”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.