What Kita users actually want

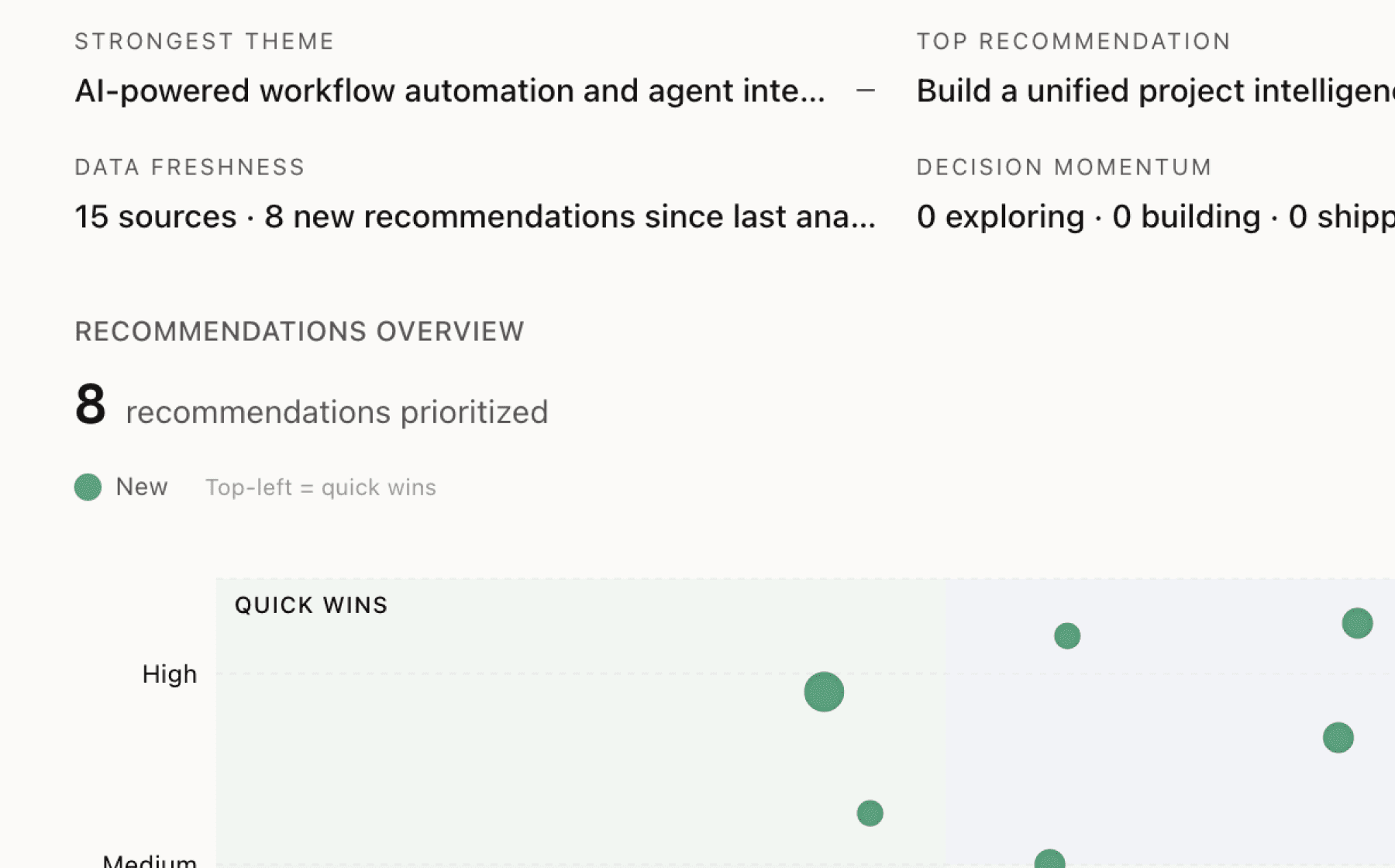

Mimir analyzed 13 public sources — app reviews, Reddit threads, forum posts — and surfaced 12 patterns with 7 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Launch white-label borrower portal with mobile-first validation to reduce incomplete submissions

High impact · Medium effort

Rationale

Pre-submission validation prevents the endless back-and-forth cycles that extend turnaround times to months and cause best borrowers to get rejected due to incomplete submissions or low-quality scans. Nine sources across multiple markets confirm this creates direct friction in the submission process — the point where user engagement begins. By catching missing pages, blurry scans, name mismatches, and incomplete fields before manual review, you eliminate the primary bottleneck that prevents lenders from scaling.

This recommendation addresses the core user experience problem while leveraging existing technical capabilities. The platform already validates completeness, cross-checks metadata, and detects quality issues. The gap is delivering this validation at the right moment — when borrowers submit documents, not after credit officers begin review. Mobile-first design is critical because target markets (Southeast Asia, Africa, Latin America) use mobile money and smartphone uploads as primary channels.

Implementing this portal drives the primary metric directly. When borrowers submit clean documents on first attempt, credit teams process applications faster, lenders approve more loans, and users see immediate ROI from the platform. This creates a compounding engagement effect — faster approvals lead to higher application volume, which increases platform usage and retention.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

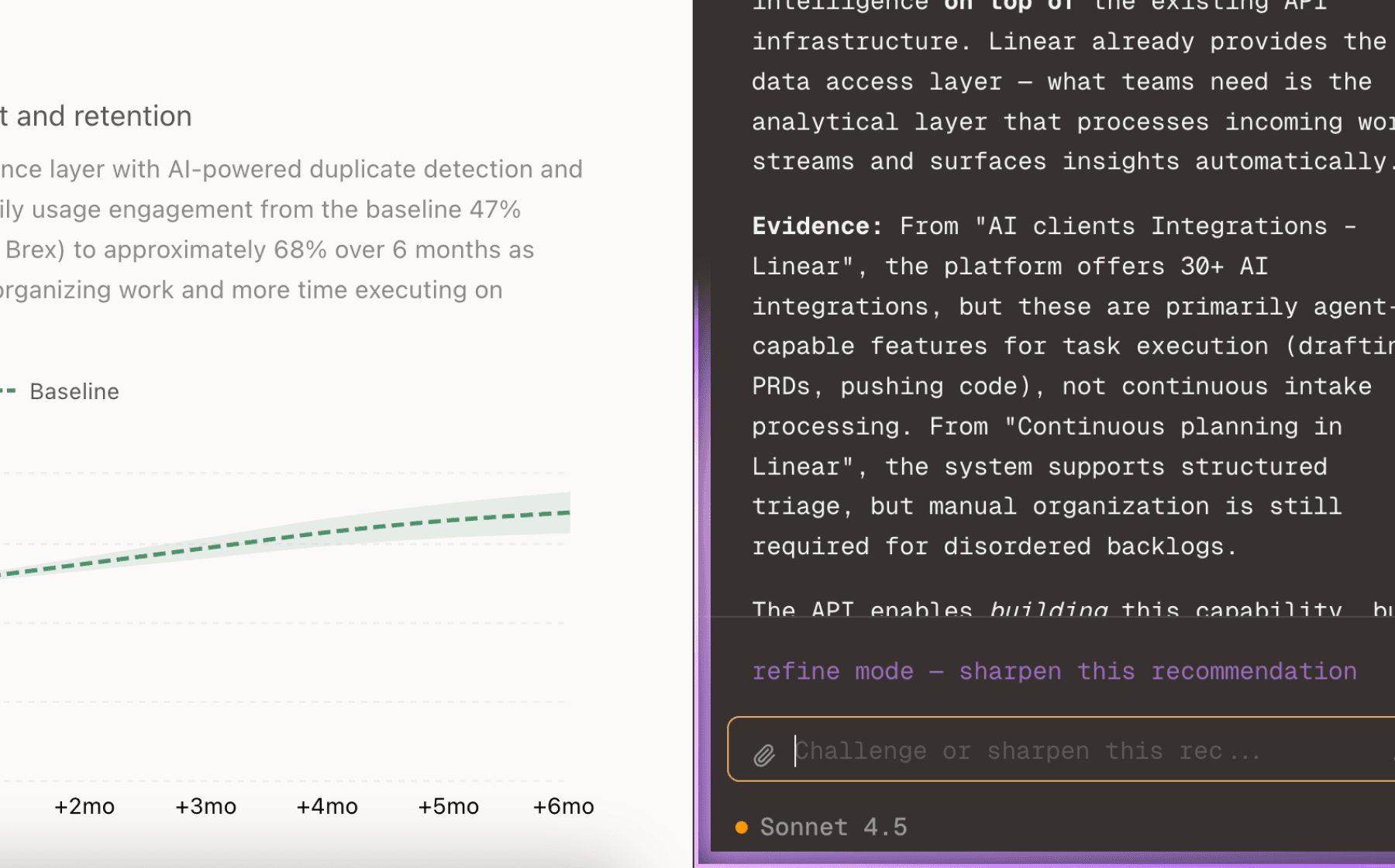

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

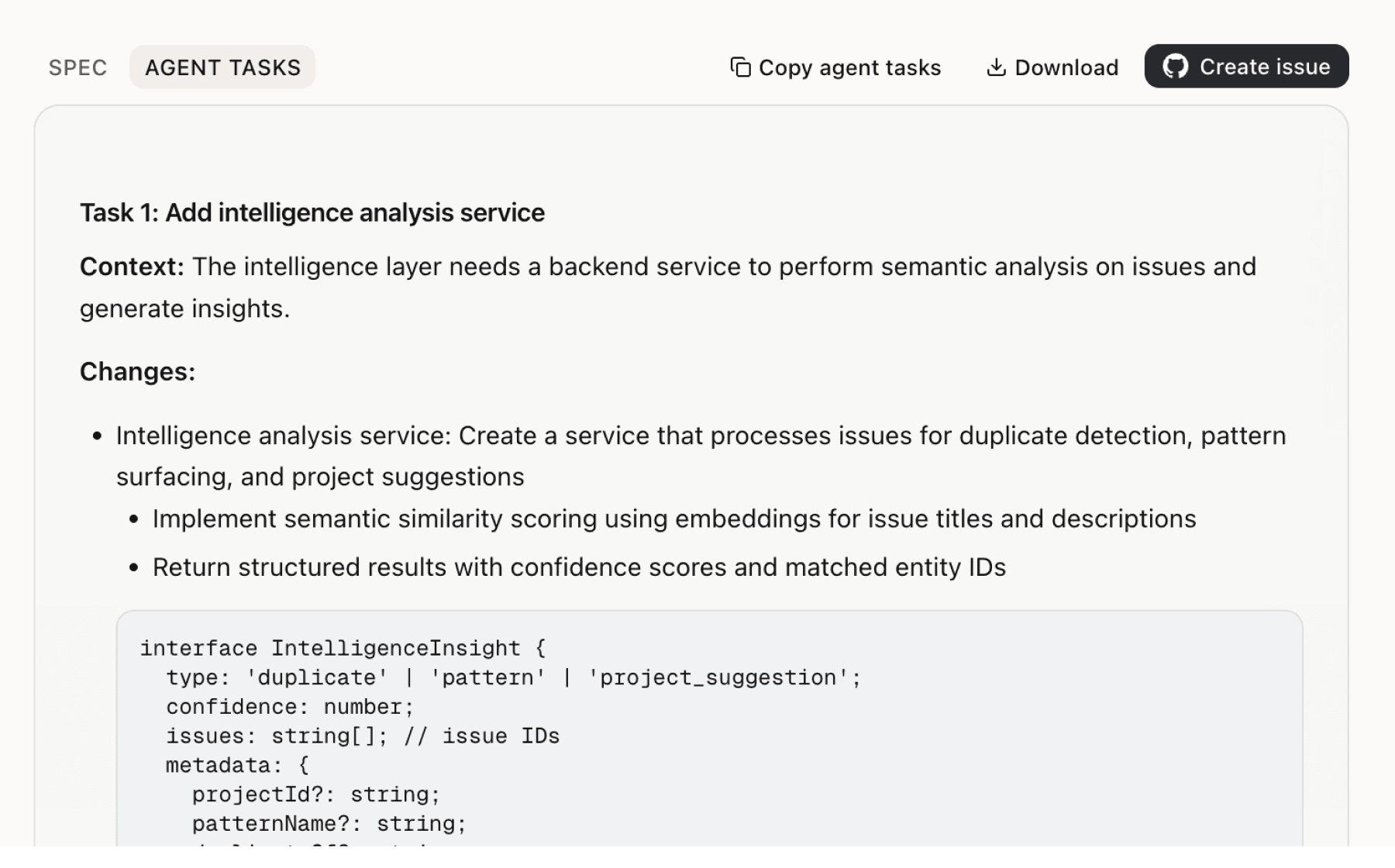

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

6 additional recommendations generated from the same analysis

Fraud detection calibrated to Philippine, Indonesian, African, and Latin American lending patterns represents the core differentiator versus generic OCR and US-centric AI tools. Sixteen sources confirm this capability enables lenders to assess informal income, handwritten records, and local document formats that legacy systems cannot process. However, the evidence suggests this intelligence exists in the extraction layer but may not surface visibly to credit officers during decision-making.

The platform extracts 48 bank statement metrics, income quality signals, statutory compliance flags, and fraud indicators across multiple document types per borrower. However, evidence suggests these signals return as isolated JSON outputs or single-document views rather than comparative analysis tools. Credit officers need to see how a borrower's payslip income correlates with their bank statement inflows, whether their tax records match their stated business revenue, and if their utility bill address aligns with their national ID.

The platform supports vastly different document ecosystems across regions — 8+ e-wallets in Southeast Asia, 14+ document types in Mexico, mobile money platforms across Africa, and non-standard income documentation for US immigrant lending. However, evidence suggests users encounter this coverage incrementally rather than experiencing it as a cohesive regional offering. A product manager evaluating Kita for Philippine lending should immediately see GCash support, BIR form processing, and fraud signals calibrated to local patterns.

Lenders using Kita process documents for new applications but likely have portfolios of historical loans with known performance outcomes. Enabling lenders to retroactively analyze which document signals correlated with defaults, fraud, or strong repayment would transform the platform from operational tool to strategic analytics system. This addresses the retention challenge by creating ongoing engagement beyond individual loan decisions.

The platform claims 98% verification accuracy and market-calibrated fraud detection across 50+ document types, but evidence shows liability disclaimers stating Output is not warranted to be accurate and Services disclaim all warranties including accuracy and error-free operation. This creates a trust gap for lenders making critical underwriting decisions. Credit officers need to understand how fraud signals work, what accuracy means in context, and where the system has higher or lower confidence.

The platform generates sophisticated underwriting intelligence including 48 bank statement metrics, income quality ratios, statutory compliance flags, and severity-leveled fraud signals. However, credit officers at mission-driven lenders and emerging market fintechs may lack training to interpret these signals correctly. A basic-to-gross ratio or variable income ratio means nothing without context on what thresholds indicate risk.

Insights

Themes and patterns synthesized from customer feedback

Kita combines Silicon Valley engineering with on-the-ground emerging market knowledge, positioning itself as a specialized document intelligence solution built for lenders in underserved markets rather than generic document processing. This expertise differentiates the product for users specifically targeting emerging market lending.

“Currently no open roles available, but team indicates hiring can happen quickly”

Product terms cap liability at $400, permit service suspension without notice, restrict geographic availability, and grant broad rights to company over user content. These restrictions may impact user trust and long-term engagement, particularly for mission-driven lenders operating in regulated markets.

“Services are geographically restricted to United States; accessibility and appropriateness outside US not guaranteed”

Platform collects web logs, session activity data, and IP information with potential linking across contexts and transfer to US for processing under different data protection laws. This raises privacy considerations for users handling sensitive borrower financial data in regulated jurisdictions.

“Web log data automatically collected includes IP address, pages visited, timestamps, URLs, device attributes, and general location”

Kita disclaims warranties on output accuracy, timeliness, and security, and prohibits use for Sensitive Personal Information processing and machine learning system training. These legal and operational constraints may limit adoption for certain lending use cases and impact user confidence in critical underwriting decisions.

“Company disclaims all warranties for Services and Output, including accuracy, timeliness, security, and error-free operation”

Two-product offering—Kita Collect for upfront validation and Kita Capture for fraud detection and extraction—allows modular deployment and targets different user needs at different stages of the lending workflow, enabling flexible adoption models.

“Kita offers two complementary products: Kita Collect for upfront validation and Kita Capture for fraud detection and data extraction”

Kita processes any document format (PDFs, scans, photos, handwritten notes, screenshots) without requiring templates or pre-configuration, with support for 50+ document types across markets and custom document types via team customization. Different regions require unique document type support (e-wallets, mobile money, local bank formats, tax records, ID types) requiring ongoing model and integration expansion.

“Support for any custom document type beyond the standard list via team customization”

The platform implements AES-256 encryption, audit logging, isolated compute environments, role-based access controls, MFA, API key scoping, regional data residency, and tested disaster recovery. Security certifications (ISO 27001, SOC 2 Type II) and data processing agreements are in progress to meet enterprise lending standards.

“ISO 27001 and SOC 2 Type II certifications in progress”

Users can deploy document intelligence in minutes rather than months via Python SDK (under 10 lines of code), structured JSON API output, no-code web portal, and batch processing capabilities. Multiple integration options (API, portal, webhook) and output formats (JSON, Excel, CSV) fit into existing lending workflows without disruption.

“Output options include structured JSON via API or user-friendly web portal UI for credit analysis”

The platform achieves 98% verification accuracy in 124ms per document with 90% reduction in turnaround times, extracting lender-focused underwriting signals including income quality, fraud detection, tampering indicators, and bank statement analysis (48 metrics). This eliminates manual re-keying and validation bottlenecks that prevent lenders from scaling.

“Manual re-keying of data points by credit officers across different formats by country, bank, and borrower causes errors and delays”

Fraud signals and document understanding are tuned to specific markets (Philippines, Indonesia, Africa, Latin America) rather than using generic models. This enables lenders to assess informal income, handwritten records, and local document formats that legacy systems cannot process, directly addressing the core value prop for emerging market lenders.

“Fraud signals are calibrated specifically to Philippine and Indonesian lending patterns, not generic models”

Pre-submission validation flags missing pages, fields, signatures, and inconsistencies (borrower names, dates, account numbers) before manual review, along with detection of blurry/cropped scans and incomplete submissions. This prevents endless back-and-forth cycles and directly reduces friction in the submission process, improving user engagement.

“Completeness validation — flag missing pages, fields, and signatures before manual review”

Billions of people are locked out of credit because their financial documents exist in unstructured formats. Kita enables lenders to serve emerging markets including informal traders, farmers, micro-enterprises, and mission-driven borrowers who lack traditional financial infrastructure, representing a critical engagement and retention opportunity with 867M+ addressable borrowers in emerging regions.

“Documents remain the source of truth for lending in emerging markets due to nascent open finance infrastructure”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.