What Healia users actually want

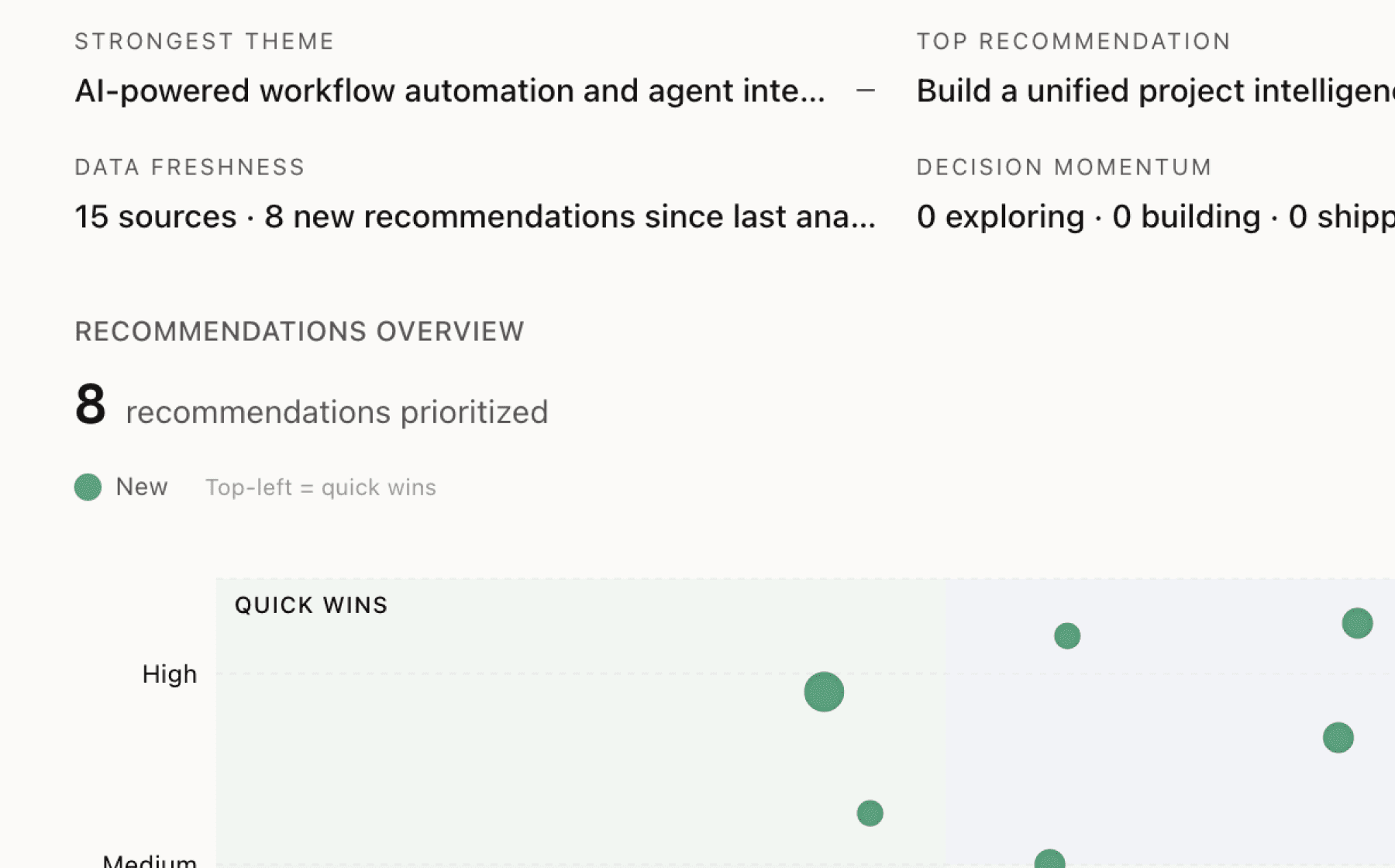

Mimir analyzed 4 public sources — app reviews, Reddit threads, forum posts — and surfaced 8 patterns with 6 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build self-service enrollment flow that surfaces Total Care Option and AI decision tool in first 30 seconds

High impact · Medium effort

Rationale

The most valuable components of the product — 76% cost reduction through TCO and $2,100 average savings from the AI tool — appear buried in complex benefit materials that dual-income families must navigate during open enrollment stress. Nearly half of married households have two working spouses, yet these families face confusion choosing between plans and cannot easily see true household costs across combinations. The data shows these tools work when used, but adoption likely suffers from poor discoverability.

Redesigning the entry experience to immediately surface the decision tool and TCO as the primary value proposition would dramatically increase engagement. The AI completes analysis in under 2 minutes, so there's no technical barrier to making this instant. New users should land on a simple interface: enter both employers, run the analysis, see savings potential, and enroll in TCO if applicable — all before touching traditional plan documents.

This addresses the root cause behind both the dual-income optimization gap and the employer overspend problem. When 30% of employees maintain duplicate coverage because they lack visibility into better options, the solution is not better marketing materials but a fundamentally different enrollment paradigm that makes the optimal choice obvious within seconds of arriving.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

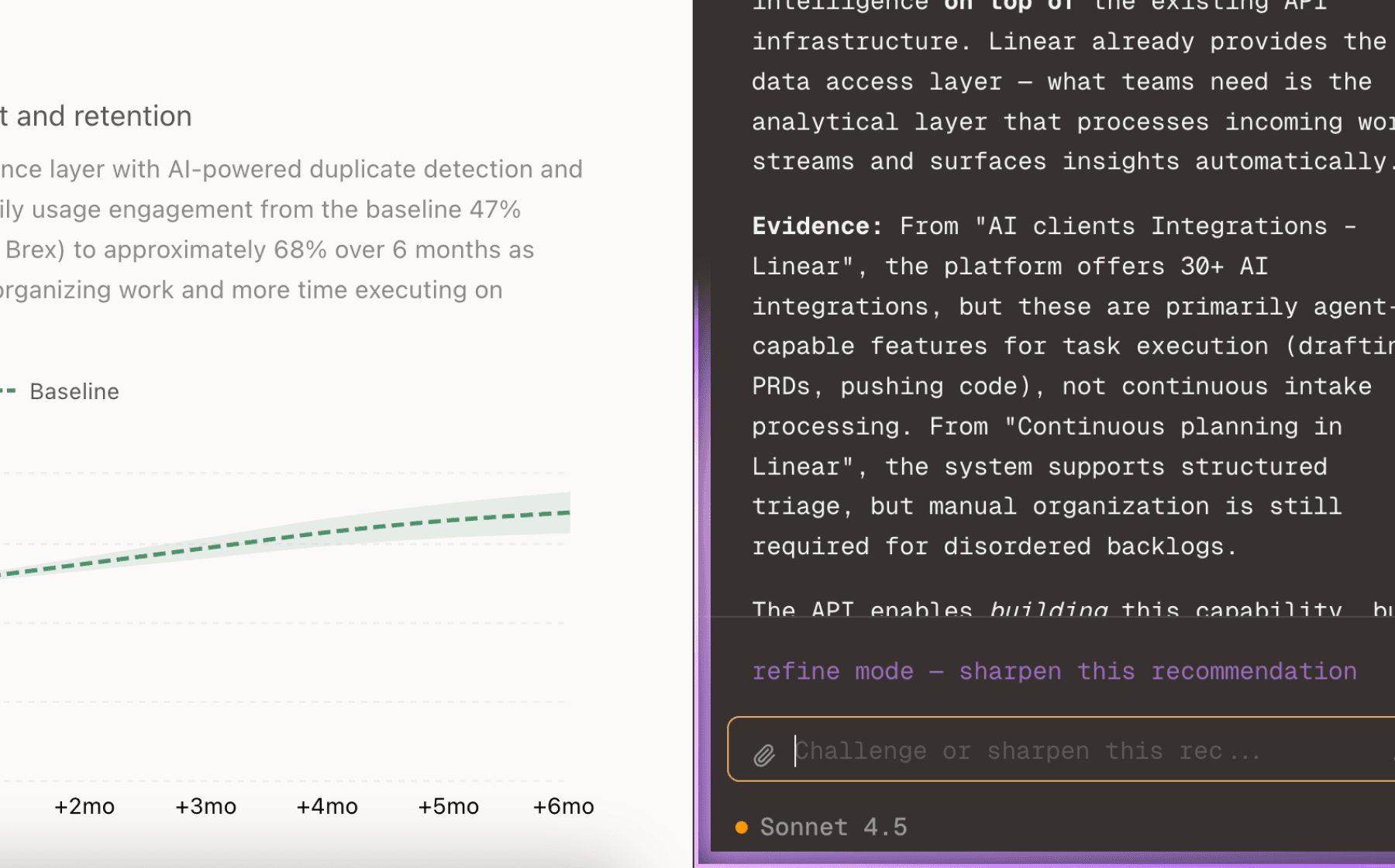

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

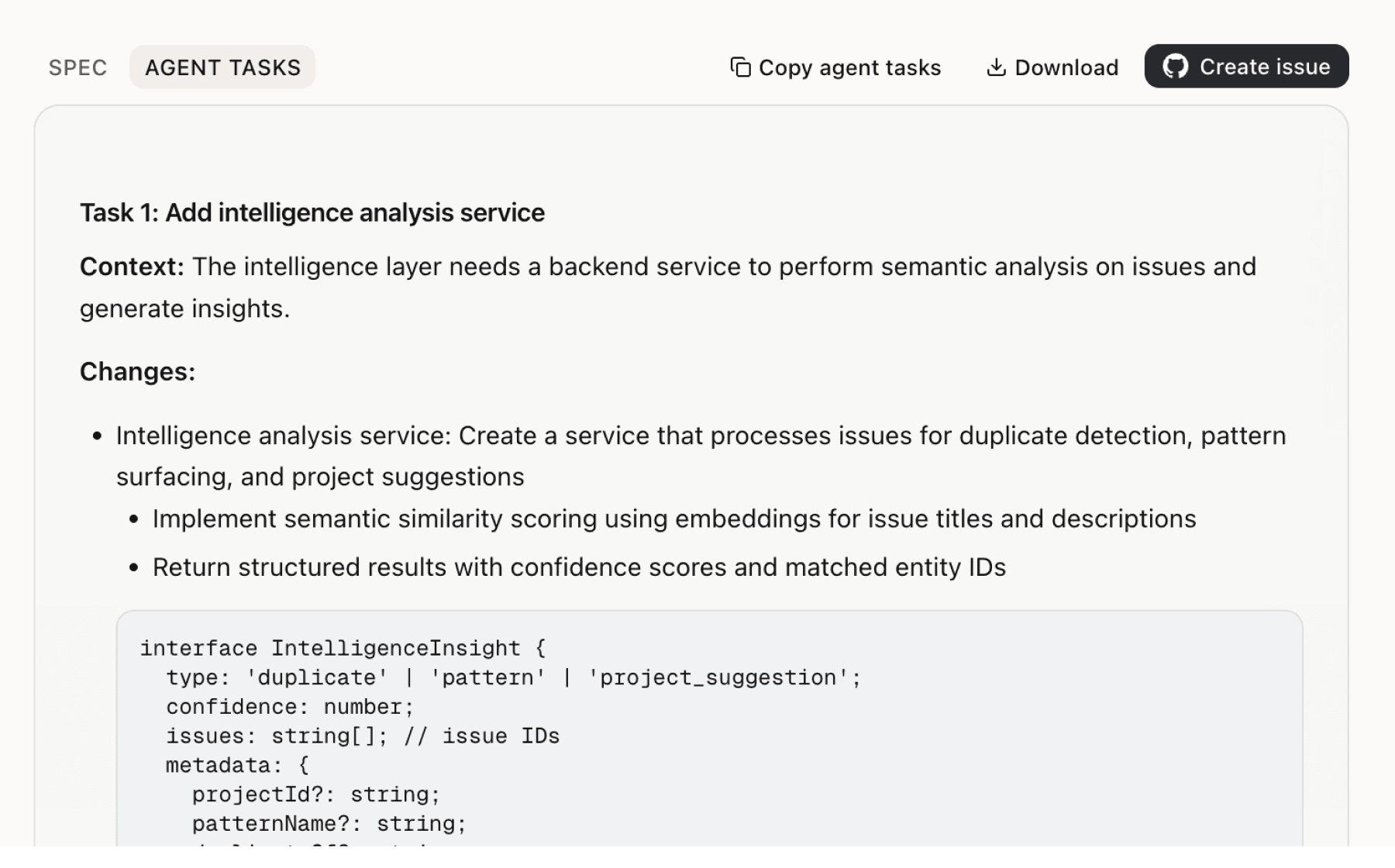

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

5 additional recommendations generated from the same analysis

With 1,250+ brokers quoting and 95% of top firms partnered, the broker channel is the primary growth engine. Yet brokers face a retention challenge where clients demand cost control without sacrificing benefit quality. The 4x ROI from TCO implementation at Bloomreach provides compelling proof, but brokers need this data for their specific book of business to drive adoption conversations and renewals.

The AI tool delivers $2,100 average savings by comparing options across both employers, but this only works if both spouses engage with the platform. Currently the product likely relies on each employer's enrollment process, which means spouses must independently discover and use the tool — a coordination problem that reduces the addressable market to single-employer households.

The claims experience already performs well with 95% processed within 48 hours and under 1 minute submission time, but these metrics suggest opportunity to push further on speed and accessibility. Healthcare expenses happen everywhere, and requiring employees to return to a desktop portal to submit claims introduces friction that delays reimbursement and reduces perceived value.

Families save $2,100 on average using the decision tool and up to $26,000 through TCO, but these benefits only become visible after enrollment and throughout the plan year. When the spouse's employer hits open enrollment months later, that family has no concrete artifact showing the value they've already received to inform their partner's enrollment decisions.

TCO delivers 76% cost reduction but requires employees to proactively enroll, which means eligible households may miss the opportunity if they don't understand the benefit during the narrow enrollment window. With 30% of employees maintaining spouse coverage, there's a large population that could benefit but likely doesn't recognize their eligibility or calculate potential savings before making enrollment decisions.

Insights

Themes and patterns synthesized from customer feedback

Employer testimonials emphasize seamless implementation experiences, comprehensive onboarding support including plan education on-site, and high perceived ease of use by employees. This suggests that strong support processes directly correlate with successful adoption and positive user sentiment.

“The Healia team went above and beyond to educate both our HR staff and employees, even coming on campus to ensure everyone understood how to make the most of the benefit.”

The product has achieved significant enterprise adoption with 1,250+ brokers actively quoting the solution, 95% of top brokerage firms as partners, and hundreds of employers implementing across the country. This broad adoption indicates strong product-market fit and establishes network effects through broker channels.

“1,250+ brokers actively quoting with Healia”

The Total Care Option (TCO) enables families to enroll in a spouse's plan while receiving up to 100% healthcare cost coverage through an HRA and coordinated claims management, delivering up to 76% cost reduction per household and up to $26,000 in additional annual coverage. Employers implementing TCO report 4x return on investment.

“Families can save up to $26,000 in healthcare costs annually using the Total Care Option.”

An AI-powered decision support tool that analyzes plan combinations across both spouses' employers and recommends the optimal choice completes analysis in under 2 minutes and identifies average annual household savings of $2,100. This tool addresses the core pain point of families lacking visibility into true costs across plan options.

“AI-powered health plan analysis tool completes analysis in under 2 minutes.”

The product enables quick claim submission in under 1 minute with direct bank account reimbursement and no additional paperwork, with 95% of claims processed within 48 hours. This reduces administrative burden on employees and creates a frictionless experience that supports engagement.

“Employees can submit claims to Healia in under 1 minute.”

Employers face sustained pressure from rising healthcare premiums year after year while needing to maintain competitive, high-quality benefits to attract and retain talent. This creates a difficult trade-off where cost control measures risk reducing benefit richness and employee satisfaction.

“Rising healthcare premiums year after year create budget pressure and make benefits unsustainable”

Nearly half of married U.S. households have two working spouses, yet families struggle with confusion and financial uncertainty when choosing between multiple employer health plans. The absence of coordinated decision-making tools means families cannot easily calculate true household costs across plan combinations, leading to suboptimal enrollment choices and unnecessary out-of-pocket expenses.

“Nearly half of all married households in the U.S. have two working spouses, yet no tailored health insurance solutions exist to help them manage costs across both plans.”

Approximately 30% of employees maintain coverage through both their employer and spouse's employer plan, creating unnecessary costs that employers absorb without visibility or optimization strategies. Companies pay tens of thousands annually for avoidable claims from uncoordinated dual-income family coverage.

“Approximately 30% of employees have spouse coverage but still enroll in primary employer plan, creating unnecessary costs”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.