What Glow Energy users actually want

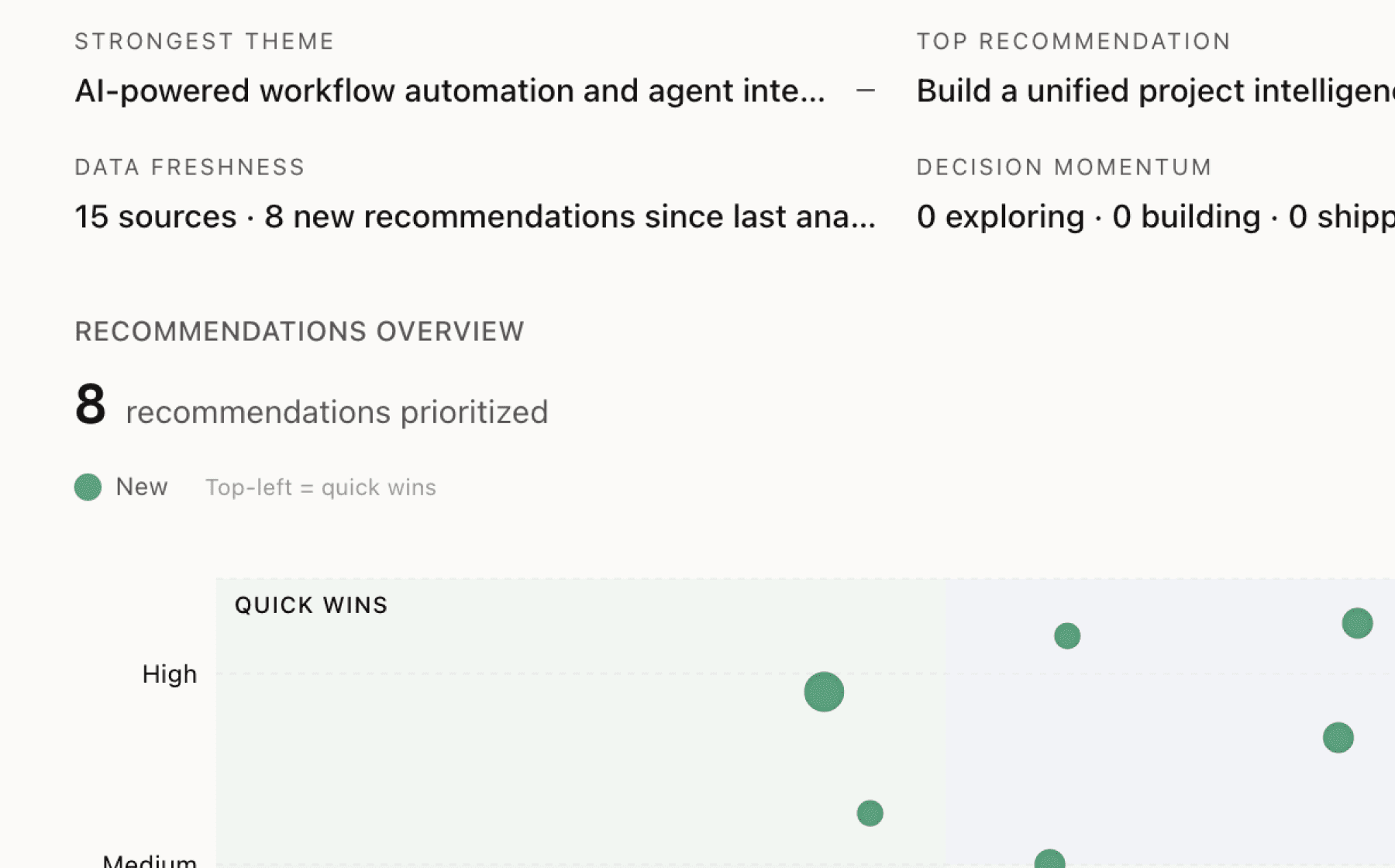

Mimir analyzed 15 public sources — app reviews, Reddit threads, forum posts — and surfaced 15 patterns with 8 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build an automated compliance dashboard that tracks February 14 deadline milestones and flags at-risk projects

High impact · Medium effort

Rationale

Twenty-one sources confirm that regulatory timing is existential to product viability. The February 14 VNEM 2.0/2.5 deadline represents a $700+ per unit annual NOI difference and determines whether projects get 20-year vs 9-year rate guarantees. Property owners making million-dollar solar investments need real-time visibility into compliance status across their portfolios.

The platform already collects all necessary data points — utility interconnection agreements, construction contracts, financing status — but doesn't surface them as a unified compliance view. Users are forced to manually track deadlines across multiple properties, creating risk of missed windows and lost grandfathering rights.

A dashboard showing each property's compliance status, required next steps, and days remaining would transform regulatory complexity from a blocker into a competitive advantage. This directly supports the core value proposition of enabling VNEM projects and maximizes the NOI optimization that drives customer retention.

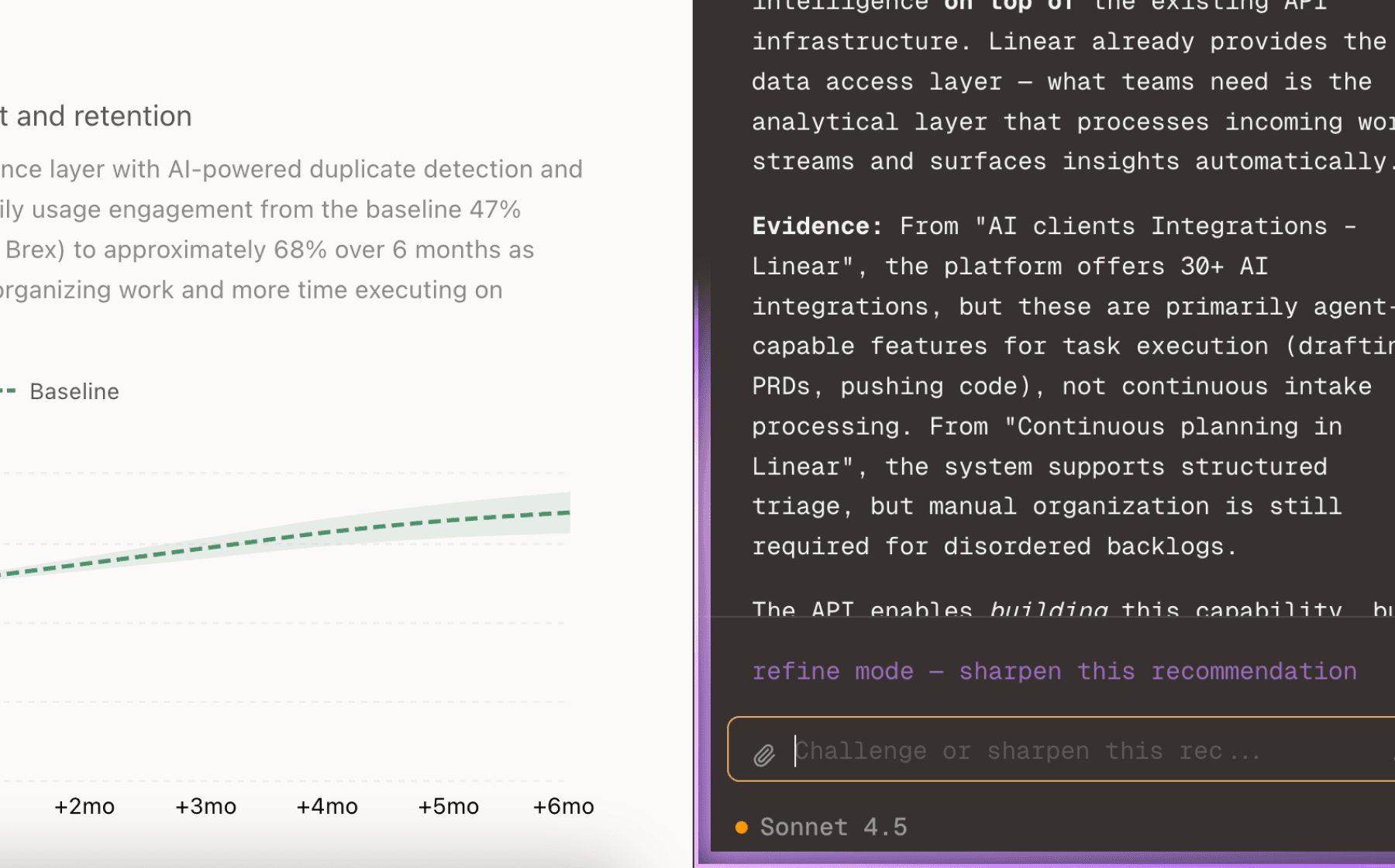

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

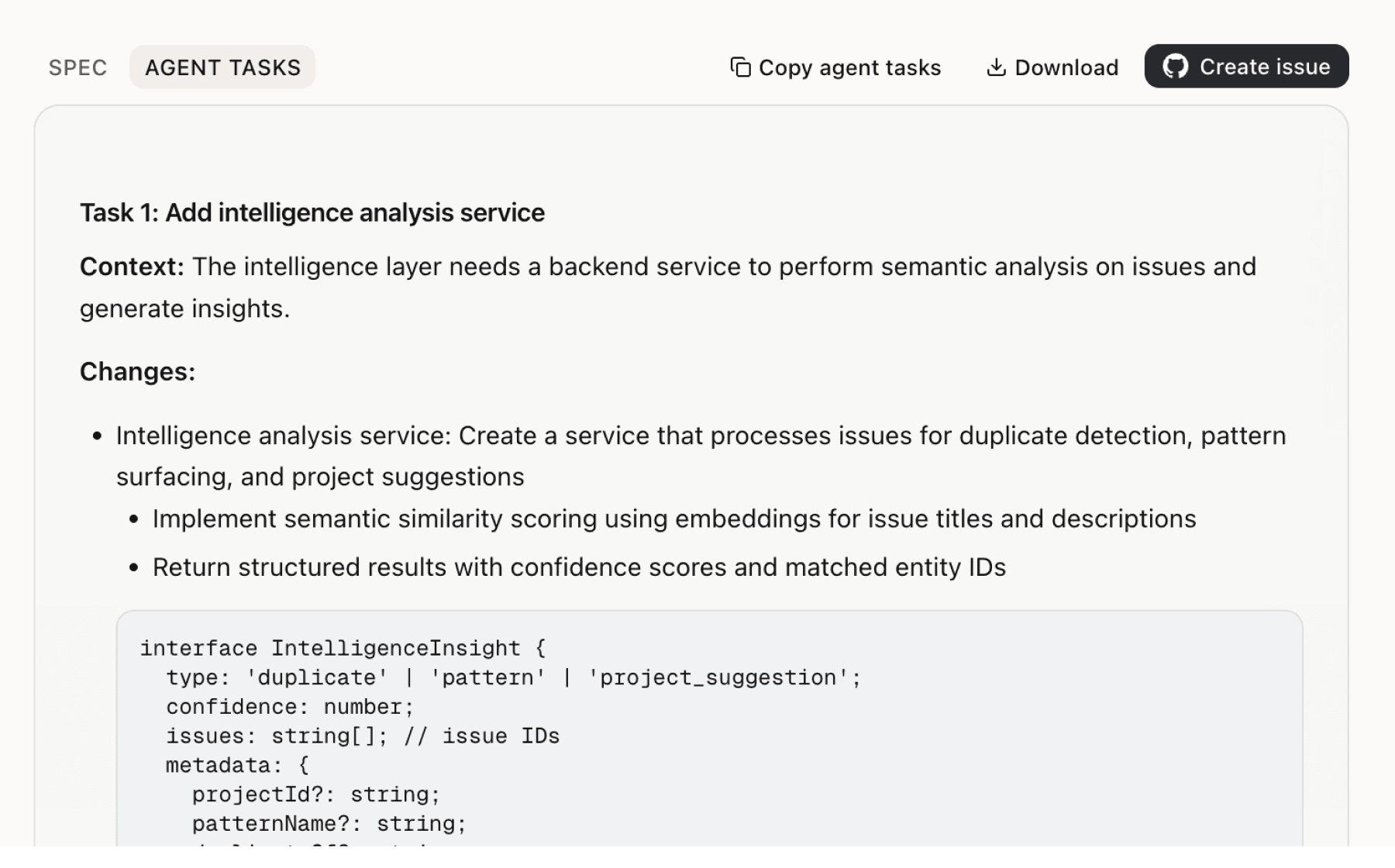

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

7 additional recommendations generated from the same analysis

Twelve sources identify enrollment friction as a retention risk, with 150+ existing units requiring action to maintain program access. The current multi-step process — open SCE account, authenticate, sign lease rider, provide SSN and driver's license — creates abandonment points that directly threaten the primary metric of user engagement and retention.

Seven sources confirm that residents consume 80%+ of building energy and represent the primary engagement opportunity. The platform already tracks energy data at 15-minute intervals and calculates transparent bill breakdowns, but this value isn't surfaced in a way that drives daily engagement.

Seven sources show that multi-stakeholder financial optimization is core to platform value, with property owners earning $700-$1,000+ per unit annually and IRA tax credits subsidizing up to 60% of project costs. The platform serves product managers and founders who need to evaluate solar investments across portfolios, but currently lacks decision-support tools for these high-stakes financial commitments.

Seven sources reveal documentation gaps that undermine user confidence. The Guides section shows zero posts, FAQ contains placeholder text, and HQ Updates has no content. Users navigating complex VNEM compliance and enrollment processes lack self-serve resources, forcing reliance on limited support hours.

Thirteen sources show the platform collects highly sensitive data including SSN, driver's license, medical-related utility rate plans, and real-time EV charging activity. Current security standards are defined only as commercially reasonable efforts, and data sharing with underwriting partners and external providers creates exposure risk.

Nine sources confirm that property management system integration is foundational to billing automation, but the current implementation requires manual enrollment of every tenant. When tenants move in or leases change, property managers must initiate a multi-step process that doesn't scale across large portfolios.

Eight sources show that binding arbitration, 10-day modification notice, and limited liability disclaimers create perceived lock-in. Combined with the commercially reasonable efforts security standard and automatic tracking disclosure, terms of service create friction for users making long-term platform commitments.

Insights

Themes and patterns synthesized from customer feedback

Glow Energy's terms include limited liability disclaimers, 10-day notice for modifications, binding arbitration that waives class action rights, and restrictions on platform reverse-engineering or service transfer. These constraints create perceived lock-in and limit user autonomy, while Glow reserves rights to remove features or discontinue service entirely.

“Glow Energy does not provide any warranties to you and these Terms limit our liability to you”

Key platform sections lack functional content (HQ Updates placeholder, Guides showing '0 out of 0 posts', incomplete customer stories and FAQ). These operational gaps in self-serve documentation and support resources may erode user confidence and slow onboarding.

“Glow Energy can add, remove functionalities, or stop supporting the Service entirely”

Product targets building owners and property managers as intermediaries, with tenant access contingent on property manager adoption and multi-step tenant enrollment. Professional services provide configuration, implementation, and training, but adoption requires coordination across multiple stakeholders.

“Product targets renters at multi-unit buildings; requires property manager/building adoption for tenant access”

Platform provides guides and educational content targeting property owners, managers, and developers on solar billing compliance, resident engagement, and renewable energy deployment strategies. These resources support adoption but are foundational to customer success.

“Glow Energy provides guides for multifamily property owners, managers, and renewable energy developers on resident energy billing and engagement”

Roadmap includes EV charger management, demand response program integration, and appliance-level control to unlock additional resident savings and revenue streams. These features are currently marked as coming soon but represent material expansion of platform value and virtual power plant capabilities.

“Device management & demand response for EV chargers and in-unit appliances marked as coming soon”

Partners and property owners need capability to model project financial performance, evaluate potential, and generate financial projections for rental property projects. This is essential for investment decision-making and partner enablement.

“Model project financial performance to evaluate potential and provide financial projections for rental property projects”

Platform offers no upfront fees and automatic service termination when leases end, reducing adoption barriers. Subscriptions auto-renew unless 60-day notice is provided, and default contract term is 5 years.

“No upfront fees or long-term commitments; service automatically ends when lease ends”

The platform enables renewable energy partners to generate professional customer proposals co-branded with Glow Energy, expanding addressable market through partnership channels and providing partners with tools to scale customer acquisition.

“Generate well-designed, co-branded customer-ready proposals that showcase partnership with Glow Energy”

The platform collects sensitive user data including utility accounts, payment information, SSN, driver's license, EV charging activity, and medical-related rate plan information via automatic tracking. Data security safeguards are defined only by 'commercially reasonable efforts' standard, and data is shared with underwriting partners and external providers, creating security and privacy concerns.

“Users must provide sensitive personal information (SSN, driver's license) to turn on SCE service, creating privacy/security concerns”

Users face significant barriers to completing and maintaining enrollment, including unclear service continuity communication, sensitive information requirements, and multi-step processes that don't scale. A large portion of existing rental units risk losing program enrollment and solar savings access if enrollment updates aren't completed, creating direct retention risk.

“Enrollment update completion required to earn savings; unclear communication about enrollment impact on service continuity”

The platform requires secure integration with tenant utility accounts and property management systems to enable billing automation and ESG reporting. This integration is foundational to core value delivery but creates friction through multi-step enrollment, account authentication requirements, and account ownership complications for VNEM compliance.

“Utility account integration allows solar energy supplementation without service interruption”

The platform enables property owners to generate multiple revenue streams (tenant electricity sales, EV charging, utility demand response payments) while optimizing NOI and ESG outcomes. This structure aligns financial incentives between owners, renters, and financial institutions—a key requirement for unlocking virtual power plant adoption across rental portfolios.

“Revenue streams include: tenant electricity sales, EV charging session profits, and utility payments for aggregated energy savings”

Residents consume 80%+ of building energy and represent the key engagement opportunity for platform adoption. Enabling renters to subscribe to rooftop solar without switching providers or long-term contracts, combined with transparent bill breakdowns and real-time savings visibility, drives both adoption and retention.

“Residents directly consume more than 80% of energy in buildings, representing key engagement opportunity”

CPUC's VNEM 2.0/2.5 tariffs create time-sensitive deadlines (February 14 closure) with dramatic economic shifts across versions (20-year vs 9-year guarantees, reduced export rates). Users must navigate complex billing compliance and secure tariff access before windows close, making regulatory timing a critical blocker for project viability and core value delivery.

“CPUC has voted to adopt the Virtual Net Billing tariff, creating market opportunity for VNEM 2.0 solutions”

The platform's fundamental value proposition is enabling property owners to supply rooftop solar directly to tenants with integrated billing, consolidating utility and solar charges into single payments. This unified billing solves fragmented workflows where standard property management forces separate payments, unlocking NOI optimization ($700+/unit annually) and multi-stakeholder alignment.

“Account Requirements include: being a Tenant of a Serviced Property, party to a Power Purchase Agreement, and registered with a Utility Data Provider”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.