What FlowiseAI users actually want

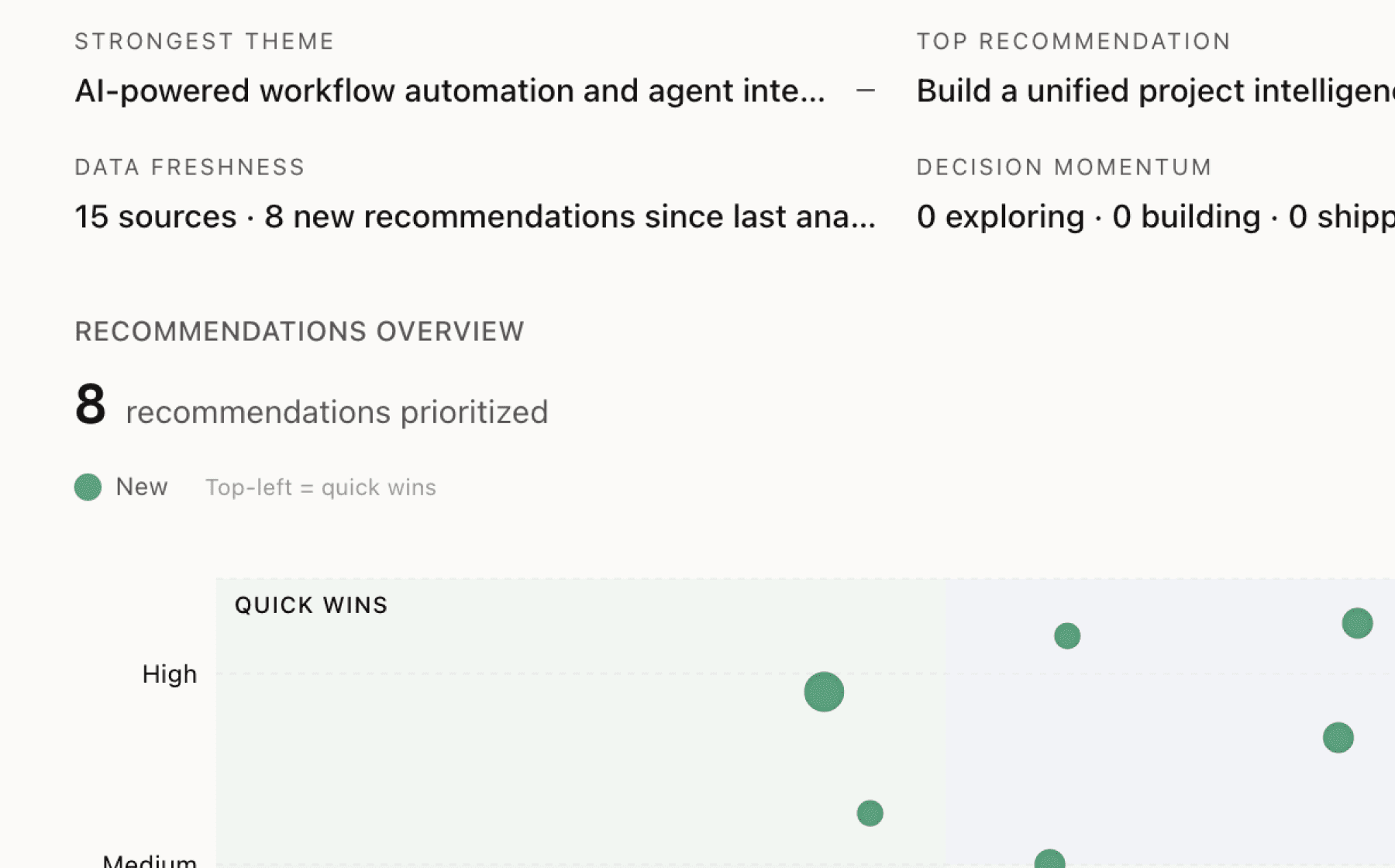

Mimir analyzed 5 public sources — app reviews, Reddit threads, forum posts — and surfaced 11 patterns with 6 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build an enterprise onboarding program that showcases proven deployment patterns from AWS, Priceline, and other major clients

High impact · Medium effort

Rationale

The Workday acquisition and adoption by AWS, Priceline, Accenture, and Deloitte represents a powerful validation signal that the platform is underutilized in marketing and onboarding. New enterprise prospects need to see how their peers solved real problems, not just that they use the tool.

Create case study templates, reference architectures, and guided onboarding flows that demonstrate proven patterns from these major deployments. This directly supports user engagement by reducing time-to-value for new users who can follow established patterns rather than starting from scratch.

The visual no-code approach makes this particularly effective since these deployment patterns can be packaged as templates that users simply configure rather than build. This leverages the platform's core differentiation while capitalizing on the enterprise validation signal.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

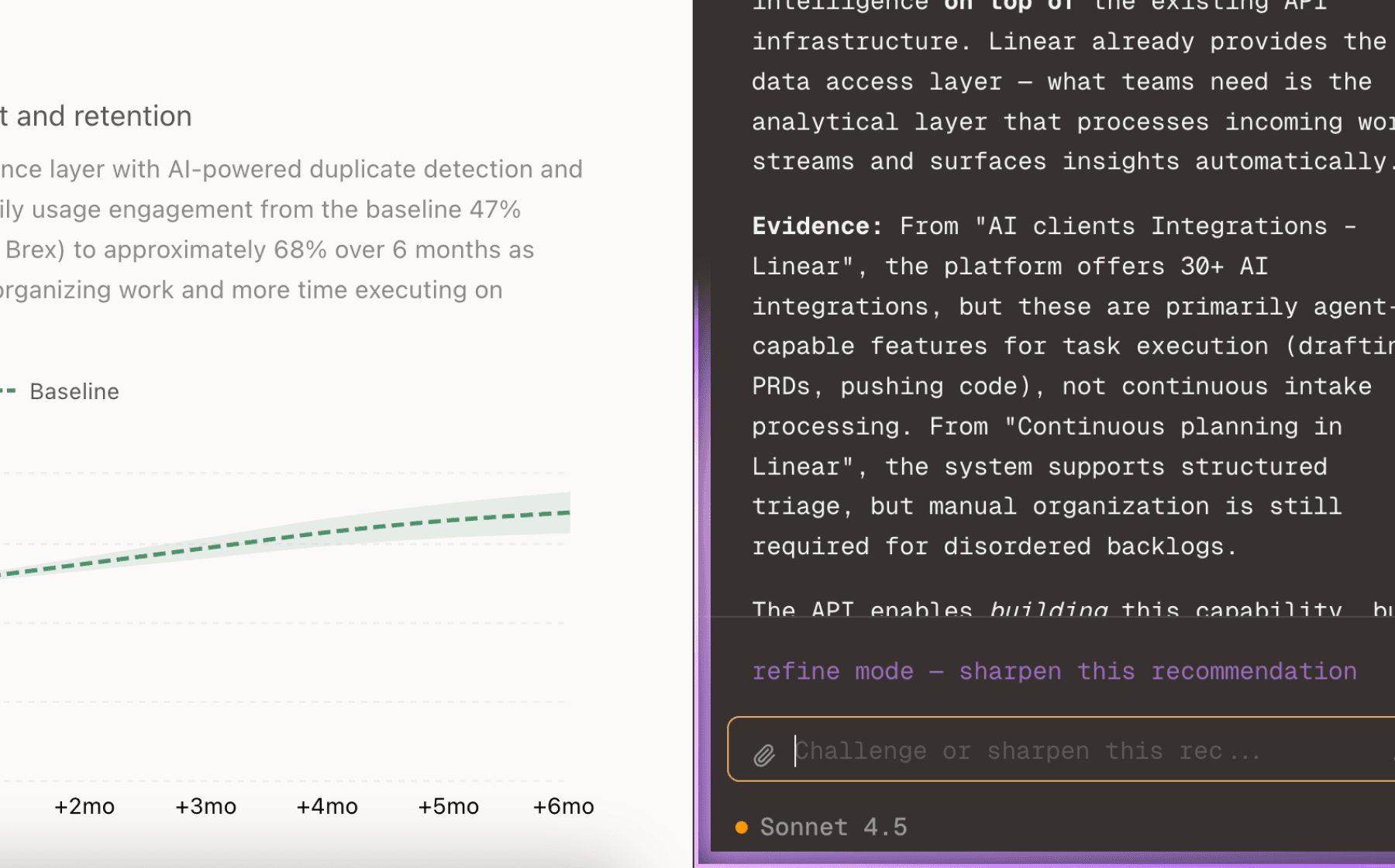

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

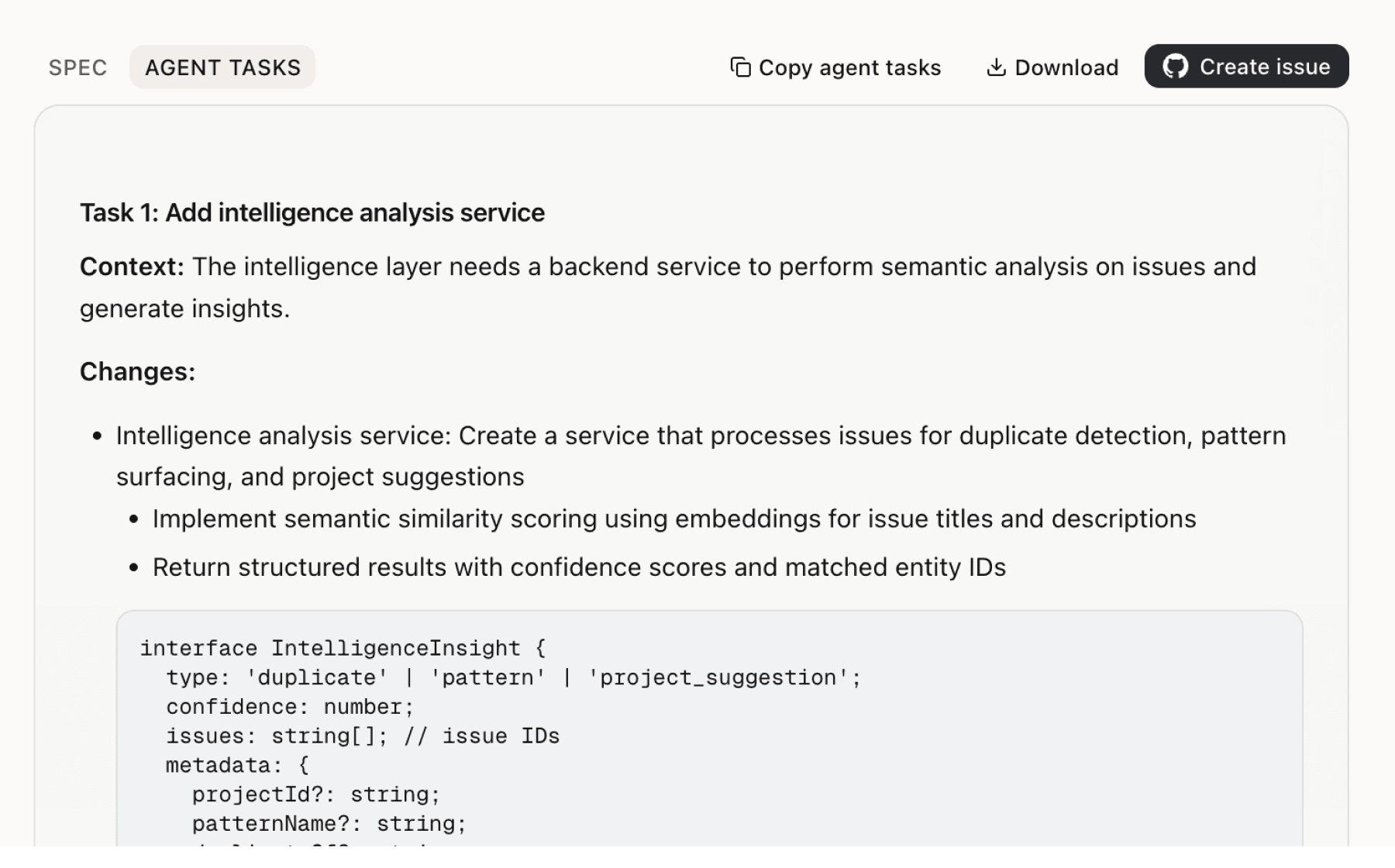

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

5 additional recommendations generated from the same analysis

Users face a binary choice between cloud and self-hosted deployment but lack structured guidance on which to choose. The data shows clear differentiation in data collection, storage location, and privacy implications between the two options, yet this decision framework appears absent from the user journey.

The visual no-code interface is the core differentiation for product managers and founders who lack deep AI expertise, but the platform appears to offer tools without teaching principles. Users can connect nodes without understanding whether they are building effective AI agents.

Users grant Flowise a non-exclusive license to their content and accept that Stripe and PostHog process their data, but the platform does not appear to visualize these data flows transparently. For product managers and founders building on top of Flowise, understanding data handling is a trust and compliance requirement.

The affiliate program offers strong economics with 20% recurring commission over 12 months and a 60-day attribution window, but affiliates need more than a dashboard to succeed. The program appears transactional when it could be a partnership that drives quality referrals.

The platform reserves the right to suspend or restrict access for operational reasons and does not guarantee uninterrupted service, which is standard but creates uncertainty for users building production workflows. Engineering leads and product managers need to assess reliability before committing to the platform.

Insights

Themes and patterns synthesized from customer feedback

Flowise operates an affiliate program offering 20% commission on referred customers' recurring payments over a 12-month period, with a 60-day attribution window. Affiliates receive real-time dashboards to track clicks, conversions, and earnings, supporting promotional optimization.

“Flowise offers a 20% commission rate on successful referrals through their affiliate program”

Flowise explicitly does not sell personal data to third parties and retains the right to use anonymized and aggregated usage data for product improvement. Anonymized data from the cloud platform may be retained indefinitely for analysis purposes.

“Company explicitly states it does not sell personal data to third parties”

Flowise uses Stripe as its Merchant of Record for payment processing and PostHog for product usage analytics on the cloud platform. These dependencies introduce third-party data processing that users should be aware of when choosing deployment options.

“Third-party data processors include Stripe (payments) and PostHog (analytics)”

Flowise does not guarantee uninterrupted or bug-free service and explicitly reserves the right to suspend or restrict access for operational, maintenance, or security reasons. This standard operational clause manages user expectations about platform availability.

“Platform does not guarantee uninterrupted or bug-free service; FlowiseAI reserves right to suspend/restrict access for operational, maintenance, or security reasons”

Flowise offers subscription plans across paid tiers with both monthly and annual billing options, as well as trial periods to allow users to evaluate the platform before committing financially.

“Subscription plans include paid tiers with monthly/annual billing options and trial periods”

Users are contractually prohibited from reverse engineering, decompiling, or extracting source code, and cannot sublicense or share unauthorized access to the platform. This protects the platform's intellectual property and security.

“Users are prohibited from reverse engineering, decompiling, or extracting source code; also cannot sublicense or share unauthorized access”

Cloud platform data is stored in the US East 1 region, which is a relevant consideration for users in regions with data residency requirements or compliance constraints. Self-hosted deployments avoid this consideration entirely.

“Cloud platform data is stored in US East 1 Region”

Flowise offers both cloud and self-hosted deployment options. The self-hosted option explicitly collects no metrics or user data, while the cloud platform uses PostHog for analytics, giving users control over their data collection preferences based on deployment choice.

“Flowise offers both cloud platform and self-hosted deployment options for their GenAI development platform”

Users retain full ownership of their content (data, configurations, workflows), but grant Flowise a non-exclusive license to use this content for service operation and improvement. This structure balances user control with the platform's operational needs.

“Users retain ownership of their User Content (data, configurations, workflows) but grant FlowiseAI non-exclusive license to use it for service operation and improvement”

Flowise was acquired by Workday, a major enterprise software vendor, signaling strong market validation. The platform is trusted and actively used by major global enterprises including AWS, Priceline, Accenture, and Deloitte across multiple industries, demonstrating broad enterprise adoption and confidence in the GenAI development platform.

“Flowise has joined Workday, indicating a major partnership or acquisition milestone”

The visual and no-code approach to AI agent development is the platform's primary value proposition, specifically targeting product managers, founders, and engineering leads. This design choice enables these users to build complex AI workflows without requiring deep coding expertise.

“Visual/no-code approach to building AI agents is the core value proposition for the platform”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.