What Flagright users actually want

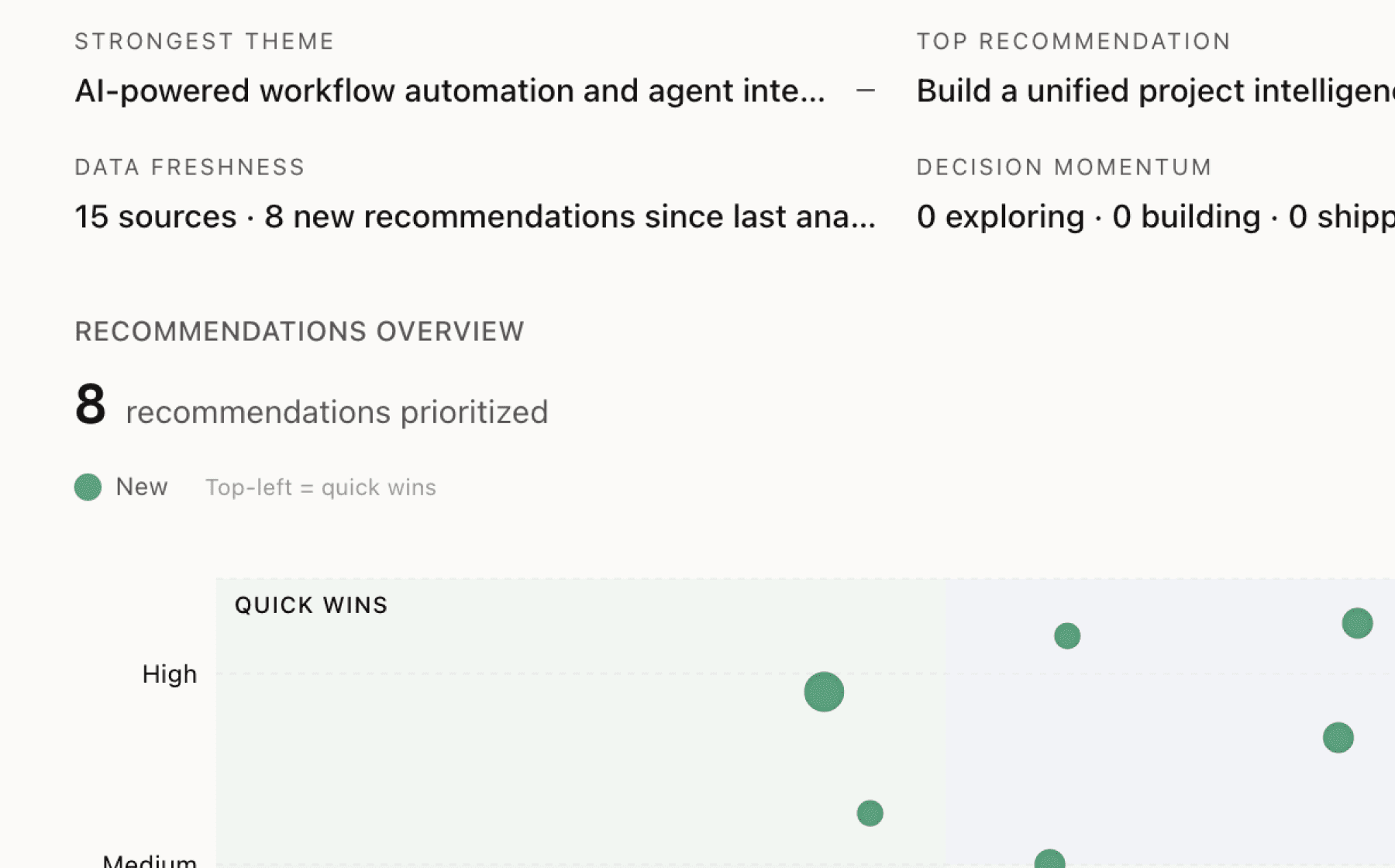

Mimir analyzed 15 public sources — app reviews, Reddit threads, forum posts — and surfaced 19 patterns with 8 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Deploy adaptive ML models with intelligent alert prioritization to reduce false positives by 85%+

High impact · Large effort

Rationale

Legacy systems generating 90% false positives create a compliance crisis that directly undermines user engagement and operational viability. Analysts spend 4 hours per alert mostly ruling out false hits, causing alert fatigue, missed genuine risks, and cascading business damage including revenue loss from declined transactions, cart abandonment, and eroded brand trust.

AI-driven anomaly detection has demonstrated 85-93% false positive reduction in production environments while maintaining risk visibility. Real users achieved 60% false positive reduction and 50% fewer resources required for reviews. This directly moves the primary engagement metric by eliminating the frustrating noise that causes analysts to disengage from the platform.

The solution requires intelligent risk scoring to prioritize suspicious activities, machine learning models that adapt in real-time to shifting patterns, and customizable rules to filter noise while catching real threats. This addresses the root cause of alert overload and transforms compliance from a defensive cost center into a strategic advantage that improves both regulatory outcomes and user experience.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

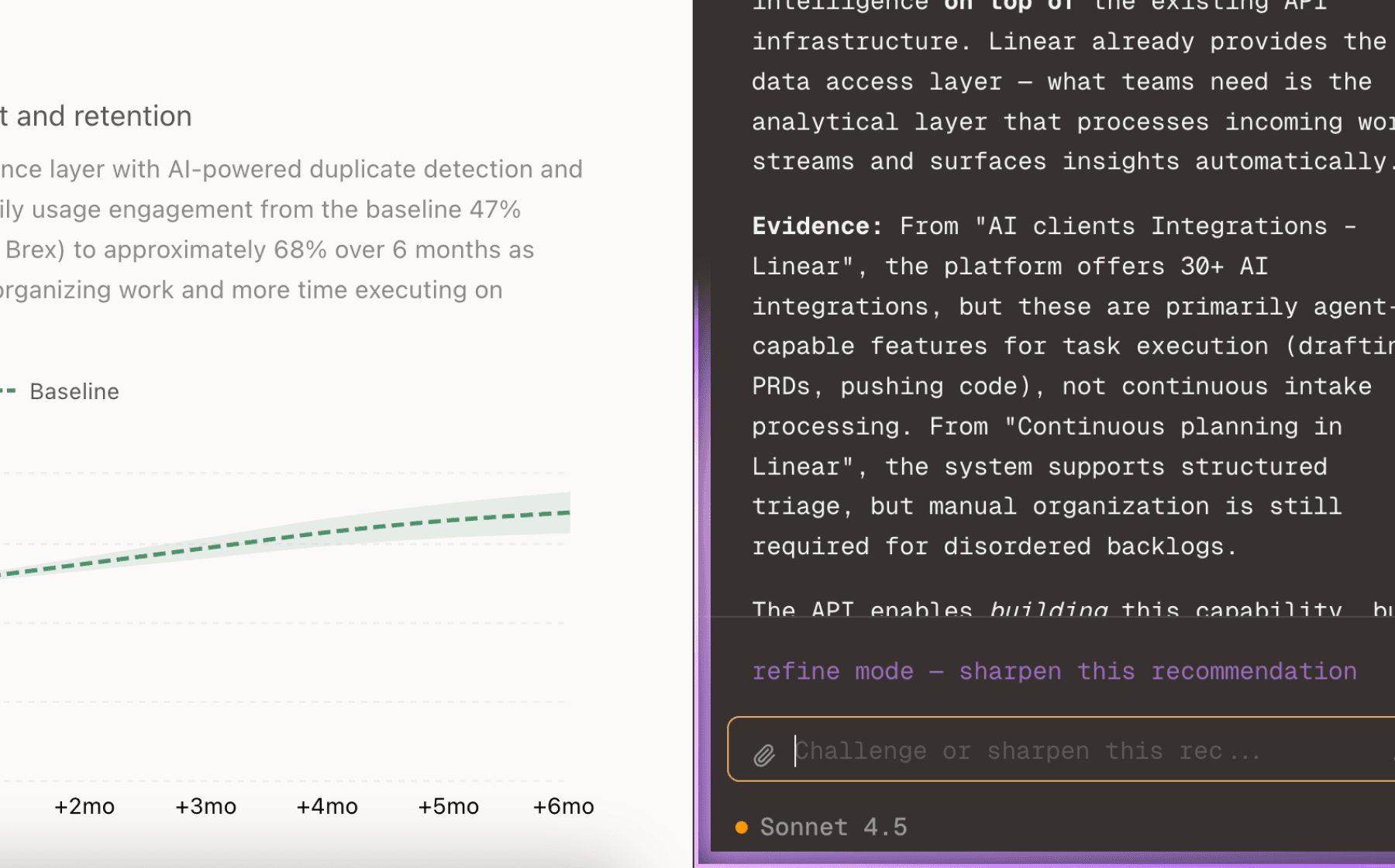

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

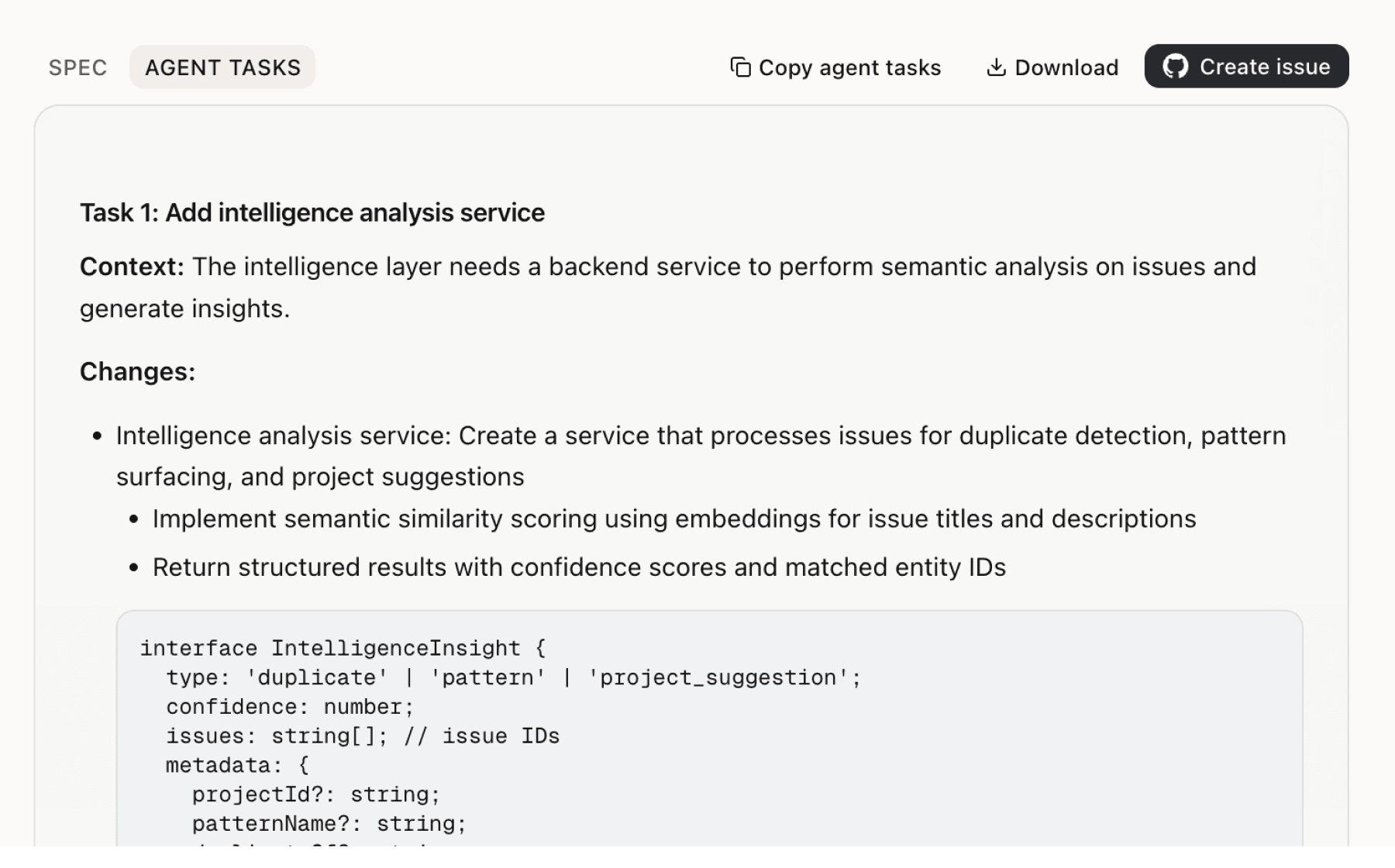

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

7 additional recommendations generated from the same analysis

Financial institutions operate fragmented toolsets with separate systems for crypto versus fiat monitoring, forcing analysts to manually pull data from multiple systems, reconcile alerts across portals, and export to Excel for investigation. This architectural fragmentation creates blind spots where suspicious patterns slip through cracks and generates duplicate alerts that waste analyst time.

Modern payment environments demand real-time response to instant payments, FedNow, crypto transfers, and 24/7 transaction flows. Legacy AML tools designed for batch processing and end-of-day reviews fail to meet instant payment requirements, creating regulatory risk and operational bottlenecks. Users need systems that evaluate transactions against hundreds of risk scenarios with sub-second response times.

Organizations operating across multiple jurisdictions face a compliance labyrinth spanning BSA, HMRC, 6AMLD, PSD2, MAS, and emerging FinCEN 2028 RIA rules across 30+ countries. Non-compliance carries severe consequences including maximum civil penalties per violation, criminal charges with imprisonment for willful violations, and public enforcement actions that damage brand reputation permanently.

Compliance teams and product managers need to build and adjust monitoring rules without engineering involvement to respond rapidly to emerging fraud patterns and regulatory changes. Current workflows requiring engineering support for rule modifications create deployment delays, reduce agility, and frustrate non-technical users who understand risk patterns but lack coding skills.

Opaque ownership structures facilitate 70% of global money laundering transactions, yet manual investigation of complex ownership chains takes 40-60 hours per case. Complex international structures span multiple jurisdictions with different disclosure requirements, making manual verification both time-consuming and error-prone. This investigation burden prevents analysts from addressing high-priority cases and creates operational bottlenecks.

Fraudsters continuously exploit new technologies and payment methods including mobile payments, blockchain mixing services, synthetic identity fraud, and DeFi layering patterns. Cross-border fraud involves at least 8 primary tactics including social engineering, false documentation, transaction laundering, and terrorist financing. The rapidly changing technology landscape allows criminals to stay ahead of static rule-based detection.

Users make adoption decisions based on industry validation, peer performance, and concrete ROI evidence rather than feature lists alone. Recognition as RegTech100 innovator for 3 consecutive years, AI FinTech100 placement, and #1 AML compliance solution by G2 Summer 2025 build market credibility that influences product managers and founders evaluating vendors.

Insights

Themes and patterns synthesized from customer feedback

Users make adoption decisions based on industry validation, peer performance, and concrete ROI evidence. Awards (RegTech100, AI FinTech100), high adoption metrics across 30+ countries, and customer case studies demonstrating measurable cost savings (60% false positive reduction, 150% alert investigation increase) build trust.

“Flagright is positioned as an AI-native AML compliance platform trusted by regulated fintechs and banks in 30+ countries”

Traditional AML platforms (Actimize, SAS, Oracle Mantas) suffer from high false positives, slow deployment cycles, poor UIs, and siloed architectures unable to handle modern data volumes and complexity. This creates opportunity for modern AI-native replacements offering superior performance and flexibility.

“Legacy AML systems (NICE Actimize, SAS AML, Oracle Mantas, FICO TONBELLER) struggle with high false positives, clunky UIs, long deployment cycles, lack of real-time capabilities, heavy consultant...”

RIAs face a 2028 regulatory deadline to establish direct AML/CFT compliance, creating urgency. Many RIAs lack existing infrastructure and expertise, representing a significant market opportunity for solutions targeting this underserved segment.

“Most RIAs are building transaction monitoring programs from scratch, lacking existing compliance infrastructure compared to banks or broker-dealers.”

Organizations managing multiple payment rails (fiat, stablecoin, on-chain) and monitoring systems face manual data pulling, alert reconciliation, and operational friction. Unified platforms consolidating monitoring logic, case management, KYC/KYB screening, and investigation workflows eliminate blind spots and reduce manual work.

“Financial institutions are adopting hybrid payment infrastructures spanning both fiat and crypto rails”

Fraudsters continuously exploit new technologies and payment methods (mobile, blockchain, mixing services, synthetic identity fraud). Solutions must detect sophisticated patterns like structuring, transaction laundering, and DeFi layering while staying ahead of emerging risks through continuous adaptation.

“Crypto monitoring must detect mixing services, peel chain analysis, dust attacks, round-trip transactions, and DeFi layering patterns.”

Users operating across multiple countries need configurable workflows, adaptable risk scoring, and built-in support for jurisdiction-specific watchlists (OFAC, EU, GoAML). Regulatory complexity drives persistent demand for intelligent, flexible configuration that scales across diverse jurisdictions.

“Lack of regulatory uniformity across jurisdictions makes it difficult to ensure compliance and prevent fraudulent activities in cross-border payments.”

Opaque ownership structures enable 70% of money laundering. Users need AI-driven entity matching (95%+ accuracy) with configurable thresholds and direct integration to official registries, dramatically accelerating beneficial ownership investigation (40-60 hours to minutes) while improving accuracy.

“AI reduces manual effort for beneficial ownership detection by 70% while improving accuracy to 95%+”

Compliance teams and product managers need to build and adjust monitoring rules without engineering involvement. No-code rule engines and visual scenario builders enable rapid deployment, faster time-to-value, and reduce dependency on engineering resources for rule iteration.

“Flexible rules engine with easy customization; ability to tailor detection scenarios to specific business models, customer profiles, and risk appetite with no-code scenario builders.”

Non-compliance carries severe consequences: civil and criminal fines, client attrition (especially high-net-worth), operational disruption, and brand damage. Users are motivated by both compliance requirements and business impact mitigation, making reliable compliance infrastructure a strategic necessity.

“RIAs must implement comprehensive AML programs including written policies, AML officer designation, employee training, and independent audits”

Financial institutions face threats from external cyberattacks, insider threats, and human error leading to data breaches. Non-compliance with security standards (PCI DSS) results in fines and operational restrictions; layered security controls, encryption, and access management are essential.

“Customer data faces threats from external cyberattacks (hacking, phishing, ransomware, malware), internal breaches (malicious/negligent employees), and third-party vendor vulnerabilities.”

Users need compliance solutions that integrate quickly (days to weeks, not months) and deliver immediate operational impact. Rapid deployment, high system reliability (99.998% uptime), and proven customer ROI enable faster implementation and reduce adoption risk.

“Integration completed in 7 days for full platform go-live at Sciopay”

One-size-fits-all thresholds fail for diverse customer bases; ultra-high-net-worth profiles have different baselines than standard accounts. Users need behavioral baselines, transaction pattern analysis, and AI-driven anomaly detection to enable context-rich, risk-based monitoring tailored to customer segments.

“Behavioral analytics to track buying habits, transaction times, and spending patterns for context-rich fraud detection”

Friction from false positives and stringent verification steps erodes brand trust and drives cart abandonment. Platforms must balance compliance rigor with seamless customer journeys to protect revenue and loyalty while maintaining regulatory effectiveness.

“False positives disrupt workflows, frustrate customers, cause transaction delays/declines, and erode brand trust”

Users need to understand why transactions or entities are flagged to build customer trust, resolve disputes faster, and defend decisions to regulators. Explainable AI models that clarify risk drivers are essential for adoption, compliance confidence, and regulatory defense.

“Explainable AI to clarify why transactions are flagged, building trust and enabling faster resolutions”

Legacy systems generate excessive false positives (up to 90%), causing alert fatigue, wasted analyst time, and missed genuine risks. Users need AI-driven models with intelligent alert prioritization and customizable rules to filter noise while catching real threats accurately, directly improving operational efficiency and user engagement.

“Alert fatigue causes compliance staff to become desensitized and overlook truly dangerous cases when facing hundreds of flagged transactions daily, nine out of ten of which are false”

Financial institutions navigate diverse, evolving regulatory frameworks (BSA, HMRC, 6AMLD/PSD2, MAS, FinCEN 2028 RIA rules) across 30+ countries with non-compliance carrying severe penalties—fines, criminal charges, and reputational damage. Unified compliance infrastructure with jurisdiction-specific workflows and regulatory intelligence is critical.

“AML compliance regulations require ongoing merchant monitoring, KYC/KYB checks, sanctions screening, and robust compliance programs with regular employee training and audits”

Modern payment environments (instant payments, crypto, 24/7 transfers) and high transaction volumes demand sub-second screening response times and cloud-native architectures. Users require systems supporting hundreds of risk scenarios, emerging payment rails, and near-zero downtime to meet regulatory and operational demands.

“Flagright's real-time transaction monitoring serves as the backbone of our compliance strategy. Week by week, we have expanded the suite of features we use, especially on the AI front. We've seen...”

Manual, time-consuming compliance workflows require excessive staffing and analyst effort on clerical tasks. AI-native solutions dramatically reduce resource requirements and processing time, enabling teams to handle high volumes without proportional headcount increases and improving detection quality.

“Banked required 50% fewer resources for flagged transaction reviews after implementing Flagright”

Users need to detect emerging risks and deploy rule changes rapidly without engineering delays. Platforms enabling quick rule-building, real-time impact visibility, fast case investigation, and responsive threat adaptation directly improve operational velocity, competitive advantage, and regulatory effectiveness.

“With Flagright in the picture, these guys move at rocket speed, and that's how we've stayed a step ahead.”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.