What F2 users actually want

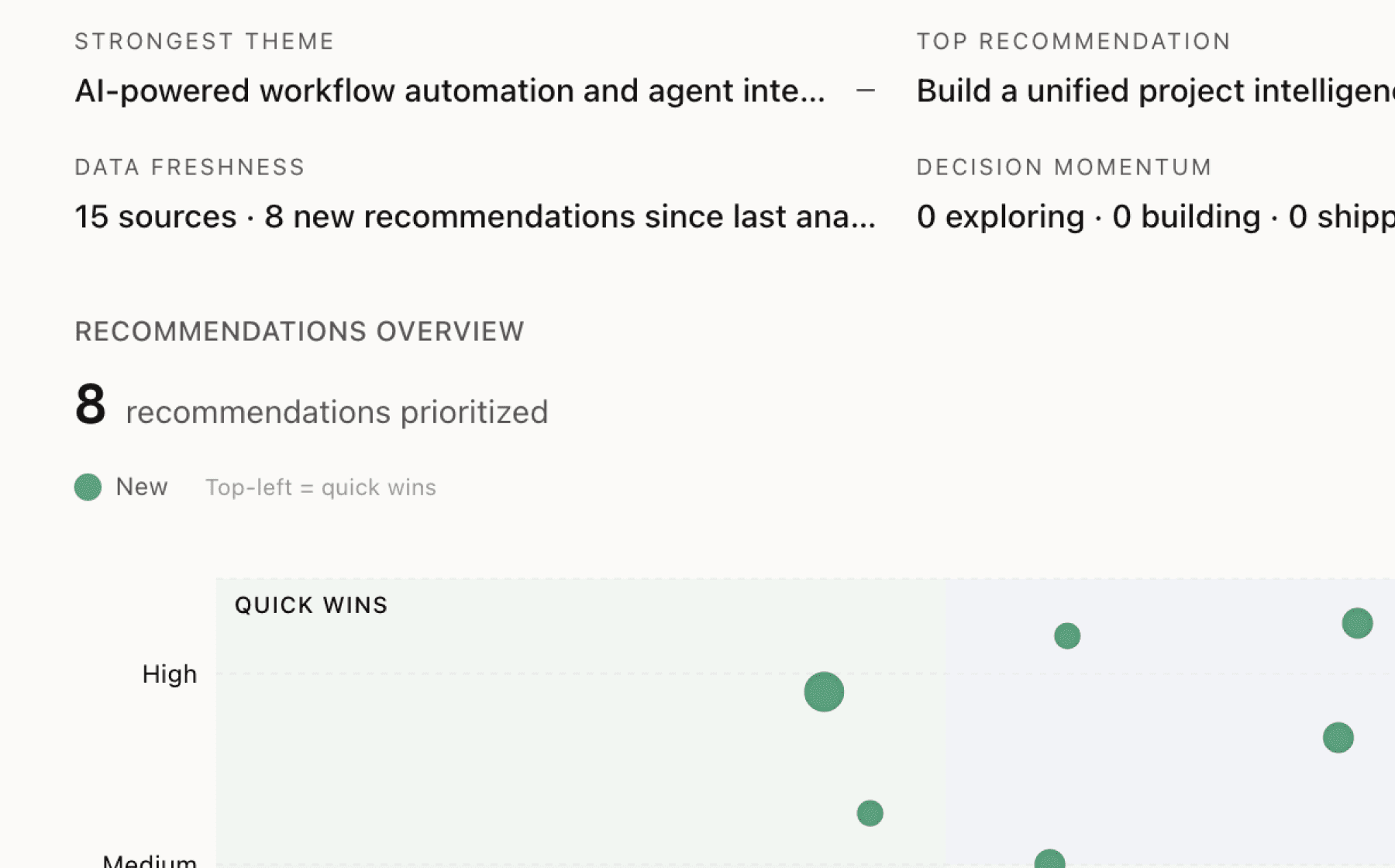

Mimir analyzed 15 public sources — app reviews, Reddit threads, forum posts — and surfaced 20 patterns with 7 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build an end-to-end automated spreading engine that ingests unstructured borrower packages and outputs normalized, audit-ready financials in minutes

High impact · Large effort

Rationale

Analysts currently spend 20-75% of their time on manual data entry, PDF-to-Excel conversion, and chart of accounts normalization — administrative work that prevents them from performing actual credit analysis. This bottleneck affects 34 sources across the research and represents the single largest constraint on deal velocity and analyst capacity. The evidence shows teams are misallocated to low-leverage tasks instead of judgment-based underwriting, and manual spreading introduces errors while delaying decisions.

The business impact is substantial: manual spreading creates a critical bottleneck in time-to-conviction, causes analysts to waste hours on incomplete deals before discovering missing documents, and forces firms to choose between deal volume and analytical depth. High-volume lenders report spreading consumes up to 75% of analyst time, leaving minimal capacity for investment judgment.

This recommendation directly addresses the platform's primary metric of user engagement and retention. When analysts can skip the grunt work and immediately begin interpreting normalized financials, they experience the product's value within the first session. The recommendation also creates a foundation for downstream automation — once financials are structured, subsequent analysis, risk detection, and memo generation become tractable.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

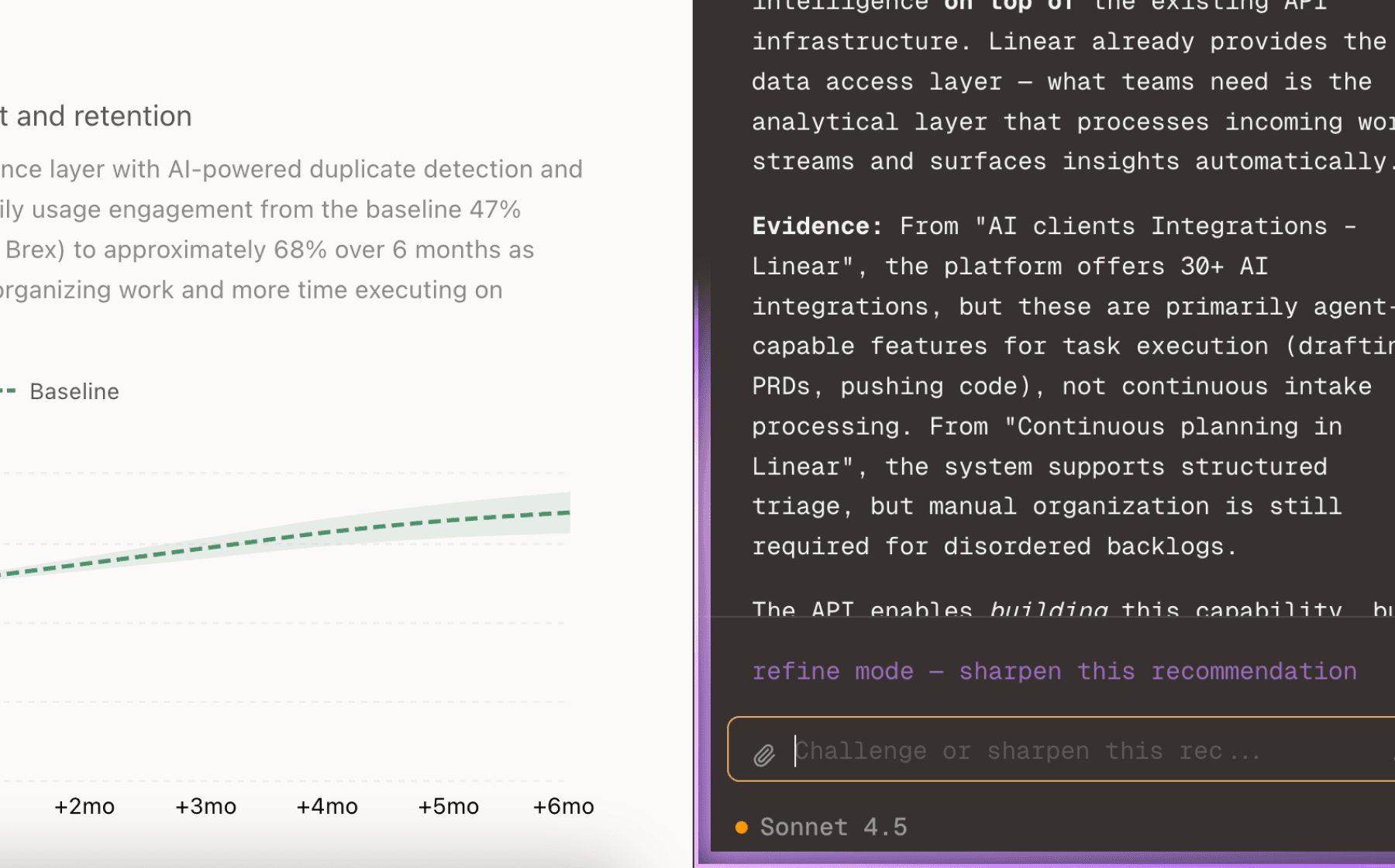

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

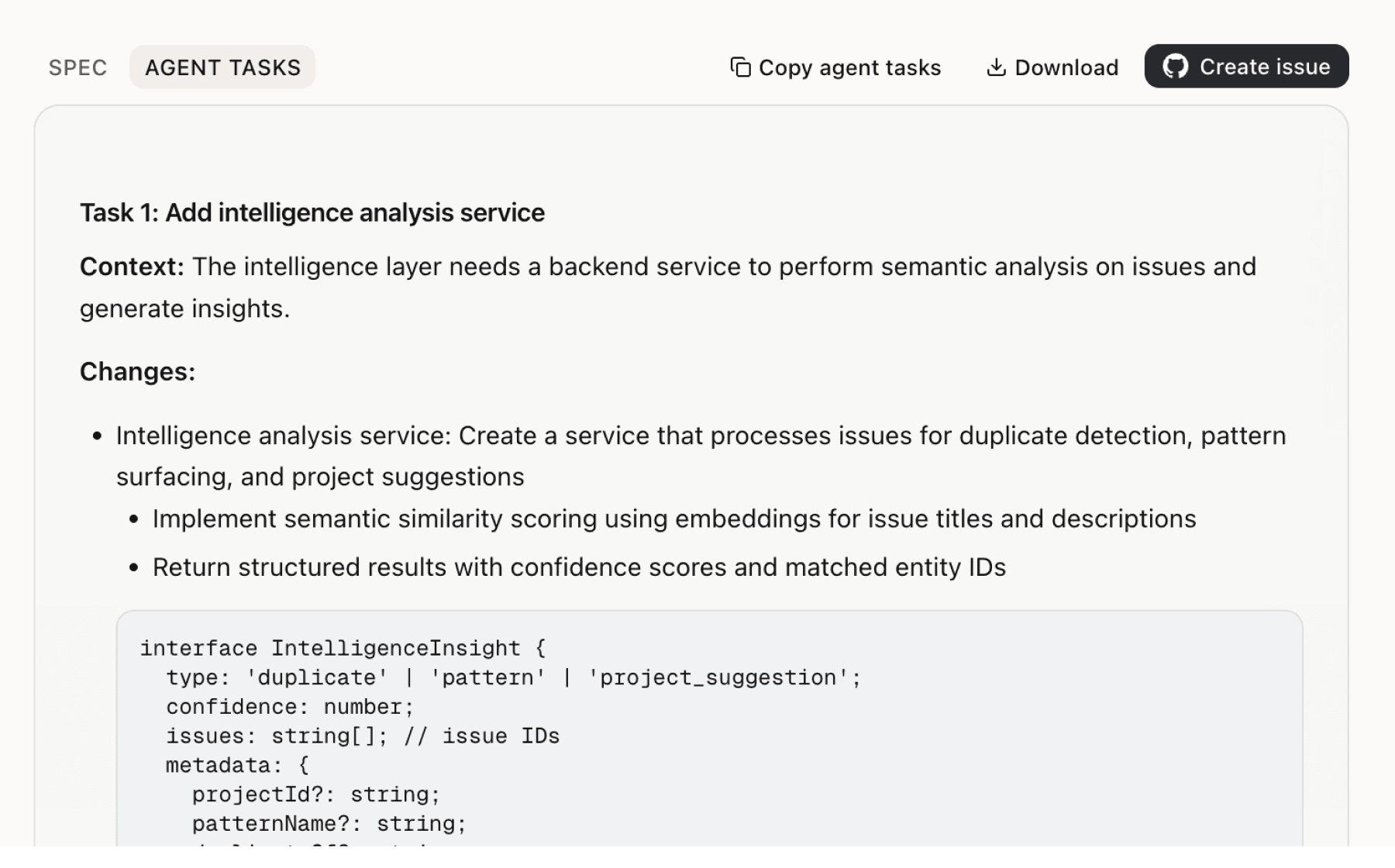

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

6 additional recommendations generated from the same analysis

The evidence shows AI-generated analysis lacks institutional credibility without complete transparency. Teams report that time savings from automation evaporate when they must manually verify every number before investment committee review, defeating the purpose of using AI in the first place. This affects 25 sources and is cited as a critical barrier to adoption.

Generic document extraction tools treat spreadsheets as flat text and miss the formula logic, cross-sheet references, and merged cell structures that underlie private markets financial models. This limitation affects 15 sources and represents a critical technical capability gap that prevents accurate financial extraction and normalization.

Investment committee memo creation consumes 20-40 hours per deal as analysts manually rebuild familiar sections, format tables, and update narratives when assumptions shift. This affects 18 sources and represents a major bottleneck in deal velocity. Teams spend time on document assembly rather than analysis, and manual transcription creates version-control errors and audit trail gaps.

Critical risk flags are buried across multiple reporting periods, spreadsheet tabs, and footnotes, making them difficult to identify when analysts are overwhelmed with document hunting and data entry. Manual deal reviews miss red flags, exposure issues, and covenant concerns despite time pressure to move quickly. This affects 11 sources and represents a critical analytical gap.

Teams evaluate opportunities in isolation without easy access to historical portfolio data, covenant templates, or prior deal logic. Institutional knowledge about borrower patterns and risk factors is scattered across old memos and senior team members' experience. This affects 8 sources and limits conviction building and strategic decision-making.

Analysts discover missing critical documents like T-12 financials after spending hours building models, wasting time on incomplete deals. Borrowers upload files with inconsistent naming conventions and disorganized structures, requiring manual triage and identification. This creates inefficiency and delays deal qualification.

Insights

Themes and patterns synthesized from customer feedback

Effective AI platforms employ agentic systems that plan actions, execute them using specialized tools, and employ feedback loops to revise approaches. This moves beyond simple extraction to the complex reasoning required for comprehensive underwriting and analysis.

“Agentic AI system plans actions, executes them using specialized tools, and employs feedback loops to revise approach until reaching final outcome.”

Analysts need conversational interfaces to query borrower data, modify assumptions, recalculate scenarios, and have downstream reports update automatically. Live model linking reduces rework and accelerates decision-making through interactive analysis workflows.

“Natural-language chatbot interface allowing analysts to query borrower data and ask the system to modify assumptions, recalculate scenarios, and rewrite IC materials”

Trillions in private capital sit idle due to inefficient diligence and underwriting processes. Faster, more accurate underwriting can unlock significant capital deployment and generate substantial business value across the private markets ecosystem.

“Trillions in dry powder sitting idle due to inefficient diligence and underwriting processes”

Traditional Excel-based approaches struggle with modern credit structures including PIK toggles, unitranche blends, and cov-lite terms that require specialized modeling logic. Platforms must handle increasingly complex capital structures.

“Traditional Excel analysis cannot keep up with creative credit structures like PIK toggles, unitranche blends, and cov-lite terms”

F2 demonstrates strong product-market fit with hundreds of active users across leading funds, banks, and PE firms, processing $10B+ in transaction volume. Real-world usage validates capabilities, enables continuous improvement, and signals market acceptance.

“Hundreds of active users across dozens of leading private credit funds, commercial banks, and PE firms are using F2”

IC memo assembly requires 20-40 hours of repetitive manual work rebuilding familiar sections, formatting tables, and updating narratives when assumptions change. Teams spend time on document assembly and alignment rather than analysis, creating a significant deal velocity constraint.

“Generates IC-ready branded reports, charts, and memos in minutes using firm's precedent materials as templates”

Borrowers present inconsistent chart of accounts, expense/revenue labeling, folder structures, and accounting logic that must be manually normalized before comparative analysis can begin. This creates inconsistency across analysts and slows financial extraction, preventing firm-wide standardization.

“Borrowers rarely follow naming conventions (e.g., 'Scan_123.pdf', 'Financials_Final_v3.xlsx'), requiring analysts to manually open, rename, and reorganize files.”

Firms gain competitive advantage by compressing diligence cycles by up to 75% while maintaining analytical rigor, allowing them to move faster in competitive bidding and deploy more capital without adding headcount. Speed combined with normalized data and peer benchmarking enables winners to close deals before competitors.

“F2 enables deal teams to compress diligence cycles, underwrite faster, and deploy more capital with precision without adding headcount”

Teams lack easy access to historical portfolio data, covenant templates, and prior deal logic when making credit decisions. Analysts cannot quickly reference similar past deals or replicate successful analysis patterns, fragmenting institutional knowledge and slowing onboarding.

“Enable instant cross-portfolio querying and benchmarking by normalizing all borrower financials to a common standardized template.”

High-stakes financial decisions require near-perfect accuracy before teams adopt automation. Users hesitate to rely on AI unless it demonstrates consistently accurate results and domain-specific understanding, making accuracy validation a critical adoption barrier.

“F2 achieves 99% accuracy standard on core financial calculations”

Teams need secure, version-controlled environments with edit tracking, comments, and clear audit trails across analyst-to-MD hierarchy. Current lack of collaboration features creates rework, accountability gaps, and prevents seamless workflow coordination.

“Real-time collaboration across analyst-to-MD hierarchy with edit and comment tracking from draft to final approval”

Deal teams require AI platforms with zero-day retention agreements, SOC/ISO accreditation, and demonstrated commitment to data security. Teams cannot adopt platforms that risk proprietary deal data being used for model training or leaking to competitors.

“F2 does not train AI models on user data; data remains private unless explicitly shared and not used for model training”

Private credit lenders and investors show strong demand for AI underwriting as standalone, focused SaaS products rather than embedded features within broader platforms. Market signals indicate preference for specialized, domain-specific solutions.

“Arc's AI underwriting technology adoption grew 10X in first half of 2025 after bundling as standalone SaaS”

Due diligence teams manually review contracts to identify key terms including renewal windows, termination rights, indemnification clauses, and payment terms. AI should automate precise extraction with exact clause citations to eliminate manual review overhead.

“Platforms must identify and interpret contract terms with precise citations to exact clauses, covering renewal windows, termination rights, indemnity, escalation clauses, and payment terms.”

Analysts spend 20-75% of their time on low-value manual tasks including financial spreading, PDF-to-Excel conversion, data normalization, and file organization. This administrative burden prevents deep analysis, delays deal decisions, and creates a critical bottleneck in deal velocity and time-to-conviction.

“Unstructured deal materials (PDFs, data rooms, spreadsheets) require manual conversion to structured, audit-ready insights”

AI-generated analysis lacks institutional credibility without complete audit trails showing exact sources, page numbers, and cell references. Teams cannot confidently rely on automated outputs for investment committee review without manually verifying every number, creating verification overhead that defeats the purpose of automation.

“AI should cite all outputs with exact page numbers or spreadsheet cell references to maintain auditability and trust”

Private credit teams face pressure to accelerate deal screening but traditional workflows force a tradeoff between rapid turnaround and comprehensive diligence. Modern capital structures and macro uncertainty require the ability to move fast while maintaining analytical rigor and risk coverage.

“Delayed time-to-conviction due to manual administrative tasks causes decision delays while sellers engage other buyers and bankers pressure for updates.”

Standard document extraction and generic tools cannot interpret Excel formulas, cross-sheet dependencies, merged cells, and complex financial logic that underlie private markets documents. Teams need domain-specific AI capable of extracting and normalizing intricate spreadsheet structures accurately.

“Generic LLMs treat spreadsheets like flat text, missing critical formula logic and cross-sheet dependencies required for institutional underwriting”

Risk flags like margin compression, liquidity deterioration, covenant violations, EBITDA adjustments, and customer concentration are buried across multiple reporting periods and spreadsheet tabs, making them difficult to identify. Overwhelmed analysts miss red flags because they are focused on document hunting and data entry rather than analytical synthesis.

“Manual deal reviews risk missing red flags, exposure issues, or covenant concerns despite time pressure to move first”

Large data rooms with thousands of files in inconsistent formats, duplicates, and unclear naming conventions create friction in identifying necessary documents and detecting missing critical materials. Teams waste significant time filtering irrelevant materials before analysis can begin.

“Large volume of data in data rooms (financial statements, legal contracts, SOPs, audit reports, compliance documents) creates friction in identifying necessary documents and filtering out irrelevant...”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.