What Corgi Insurance users actually want

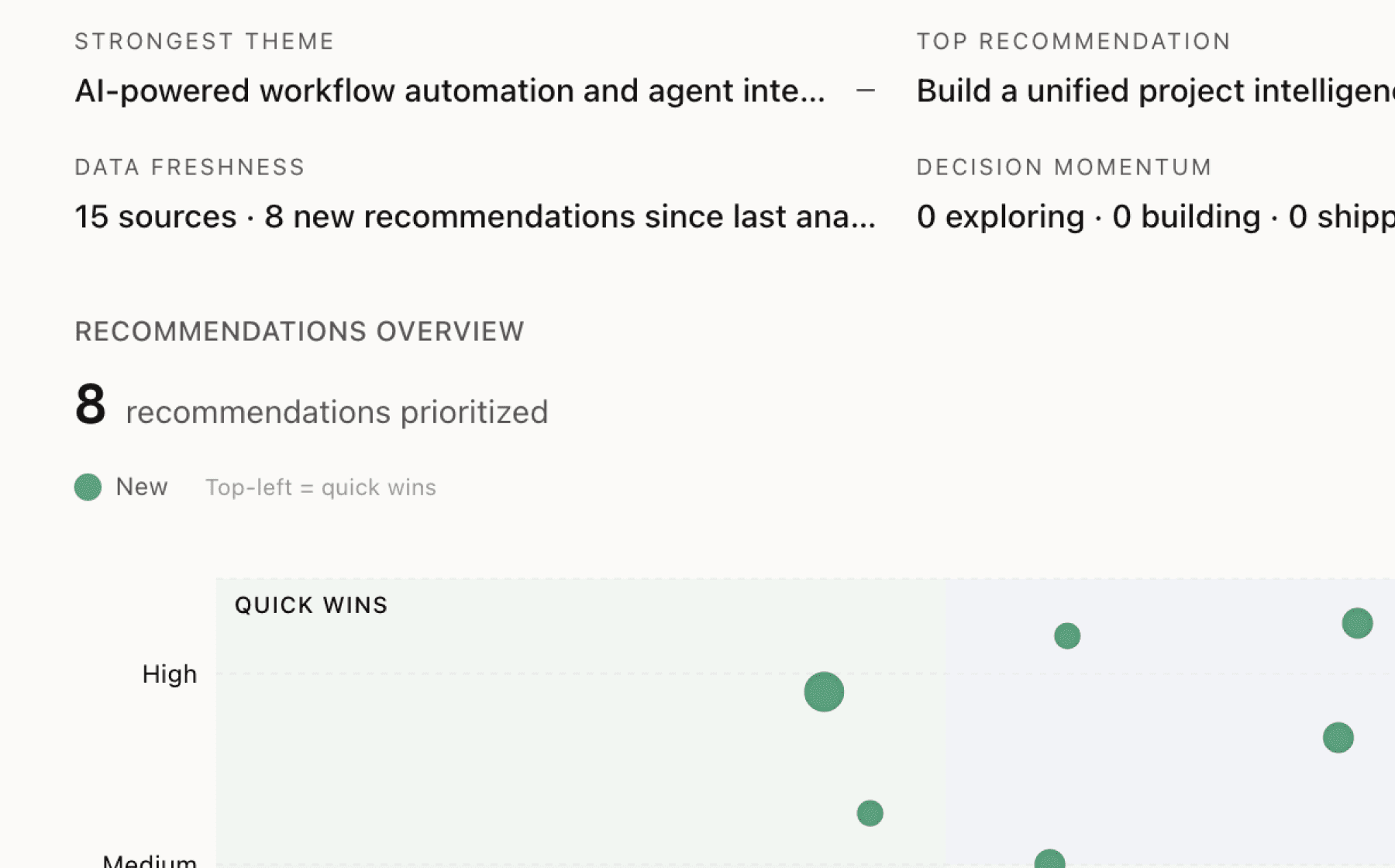

Mimir analyzed 14 public sources — app reviews, Reddit threads, forum posts — and surfaced 15 patterns with 7 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build a self-serve deal acceleration dashboard that tracks COI issuance against active enterprise pipeline

High impact · Medium effort

Rationale

Instant COI delivery is closing 7-figure contracts, but founders lack visibility into how insurance blockers impact their sales cycles. The data shows 27 sources confirming that COI requirements gate enterprise deals, and traditional brokers create 3-12 day delays that cost founders revenue velocity. A dashboard that surfaces when a deal is waiting on insurance documentation and automatically delivers COIs as coverage activates turns insurance from a passive compliance tool into an active sales enabler.

This recommendation directly moves the primary metric by transforming insurance from a one-time setup task into a recurring engagement driver. Founders who see Corgi accelerating deals will return for additional coverage modules and refer peers facing similar bottlenecks. The feature capitalizes on the existing speed advantage but surfaces it at the moment of maximum founder urgency.

Implementation requires linking insurance activation events to deal status tracking, likely via CRM integrations or a lightweight internal pipeline tracker. The high impact stems from converting a core differentiator (speed) into persistent engagement behavior, while the medium effort reflects integration and UX design requirements.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

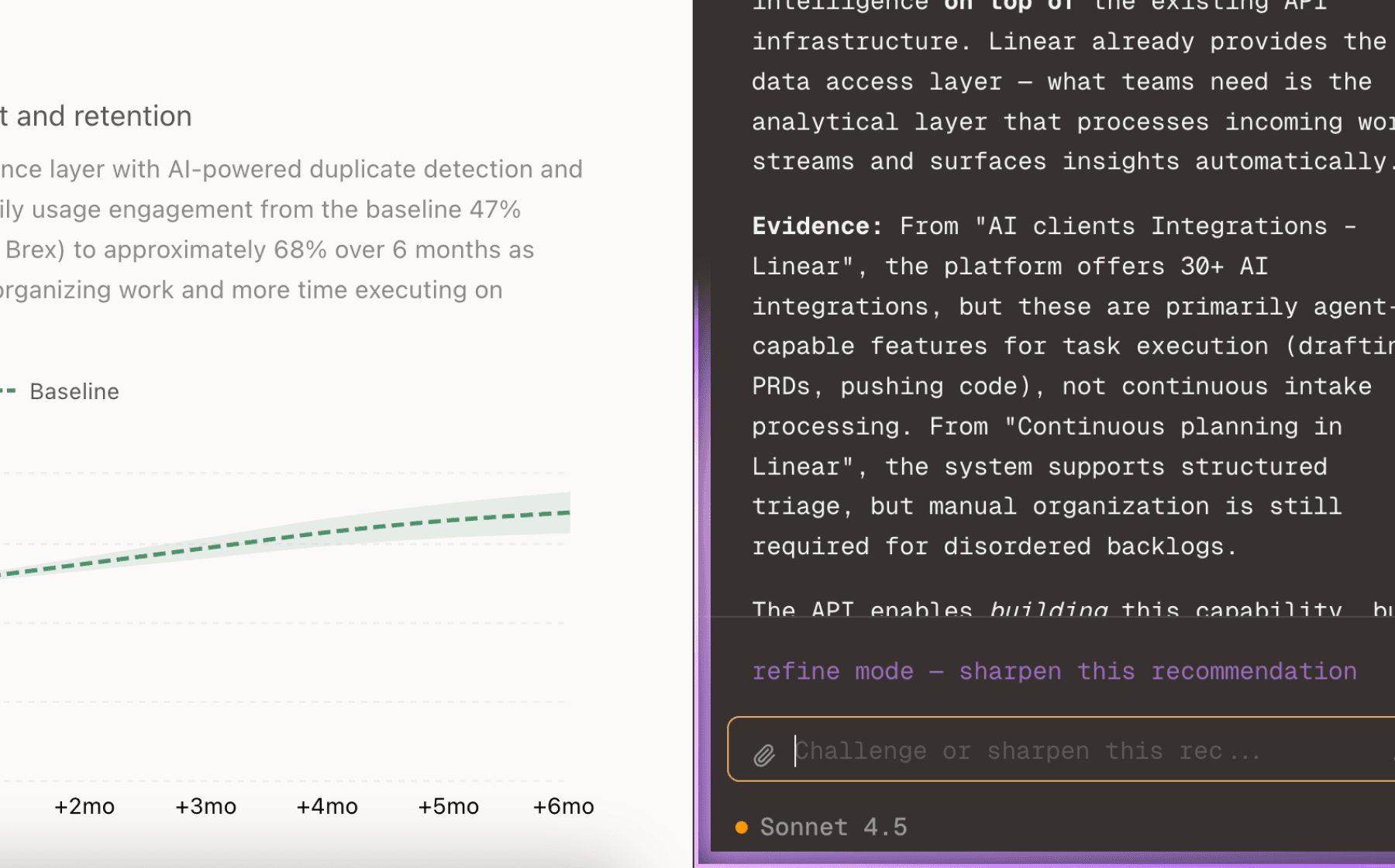

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

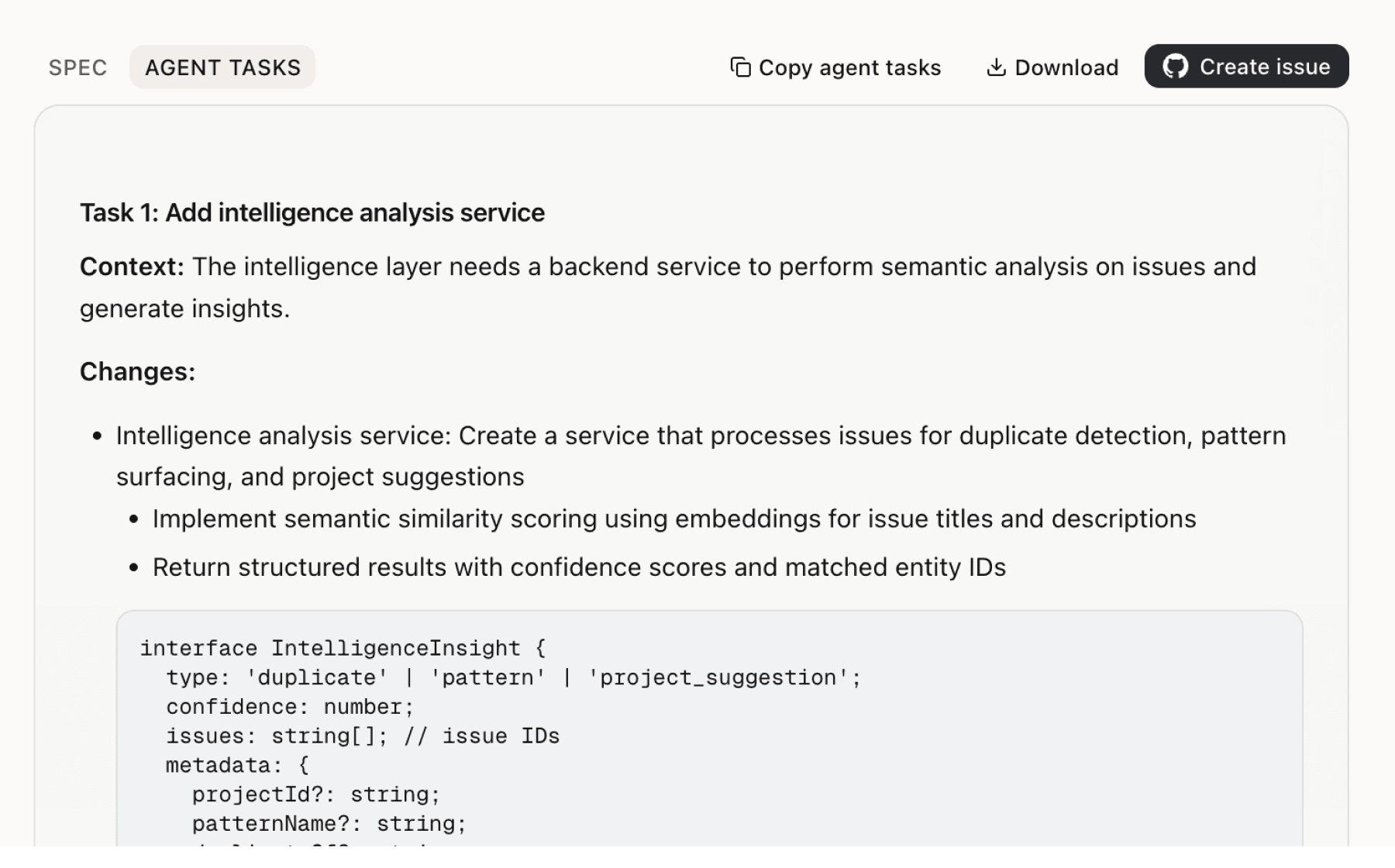

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

6 additional recommendations generated from the same analysis

Enterprise buyers and VCs now require proof of AI risk management before deals close, but founders lack frameworks to assess their specific exposure. The evidence shows 10 distinct AI risk vectors that traditional Tech E&O policies miss, including LLM hallucinations, training data disputes, algorithmic bias, and agentic AI failures. Founders cannot buy coverage intelligently without understanding which risks their product creates.

Founders toggle between under-insurance and over-insurance because they lack signals for when their risk profile changes. The data shows clear stage gates (Series A board requirements for D&O within 30 days, SOC 2 compliance requiring cyber proof, enterprise MSAs demanding higher limits) but no product systematically surfaces these triggers. A founder who closes a Series A does not intuitively know that D&O is now a board mandate or that their Tech E&O limits are insufficient for Fortune 500 contracts.

Traditional underwriters do not understand digital-native risk profiles like API downtime, payment processing failures, or marketplace trust-and-safety incidents. The evidence shows that vertical specialization is a differentiator, but product experience does not yet translate industry-specific risks into quantified exposure that justifies coverage choices. A SaaS founder cannot compare the cost of a data breach against the cost of insurance because risk calculators treat all software companies identically.

Corgi already partners with Y Combinator, StartX, and Entrepreneur First, but founders still discover insurance as a manual task rather than an integrated funding step. The evidence shows aggressive partnership expansion but no product integration that embeds insurance into the funding workflow. A YC founder closing a seed round should receive a pre-configured Corgi quote and COI as part of the standard post-investment checklist, not as a separate research and procurement task.

Founders report 10x cost savings but discover this advantage only after requesting a quote. The evidence shows pricing is a major conversion driver, yet the product does not surface this differentiation proactively. A founder evaluating Corgi against a traditional broker cannot quantify savings until deep into the decision process, reducing the likelihood that price-sensitive early-stage founders even enter the funnel.

Corgi's content strategy targets builders and frames the company as engineering insurance infrastructure for the next hundred years, but this narrative lives primarily in press coverage and the about page rather than the core product experience. Founders engage with insurance as a transactional compliance task, not as a strategic infrastructure partner. The content strategy has not yet translated into product features or engagement loops that reinforce this positioning.

Insights

Themes and patterns synthesized from customer feedback

Corgi positions itself as engineering financial infrastructure for the next hundred years and explicitly targets founders and builders through content focused on industry transformation and work-life integration. This narrative positioning builds brand affinity and engagement beyond transactional insurance.

“Media coverage focuses on AI startup founders and work-life integration themes”

Corgi is recruiting across engineering, sales, operations, and compliance roles while building partnerships with accelerators (Y Combinator, StartX, EF) and fintech platforms (Mercury), indicating a clear go-to-market strategy and infrastructure to support rapid user acquisition and retention.

“Corgi is actively hiring across multiple roles including engineering, sales, operations, and compliance”

Corgi's 'Built for founders, by founders' messaging emphasizes minimal founder mindshare and hassle-free scaling, directly addressing the reality that insurance is a distraction from core business building. This positioning resonates with time-constrained startup leaders and drives faster adoption and engagement.

“Corgi offers comprehensive startup insurance products including D&O, cyber, general liability, E&O, EPLI, fiduciary liability, and media liability insurance”

Corgi offers specialist calls, targeted educational content across insurance types and startup stages, and expert guidance on compliance requirements. This support layer helps non-insurance-expert founders understand their coverage needs and regulatory obligations, increasing engagement and retention.

“Corgi is producing educational content targeting founders across multiple insurance types and startup stages (Pro-Seed, Seed, Series A, Growth)”

Corgi's practice of requesting only email initially and collecting additional data only when needed for personalized quotes lowers the barrier to entry and demonstrates respect for user privacy. This approach is particularly resonant with privacy-conscious founders and reduces signup abandonment.

“Corgi collects minimal personal information to activate service—only email required initially, with additional data needed for personalized insurance quotes”

Corgi's recruitment of Senior P&C Underwriters alongside competitive engineering salaries indicates investment in blending AI-native development with deep traditional insurance domain expertise. This balanced approach ensures underwriting rigor and risk management alongside technological innovation.

“Engineering roles offer competitive salaries ranging from $140K-$300K across multiple locations (Dallas, Atlanta)”

Corgi's expansion into payments and publicly traded ETF products (Corgi Funds) positions the company as a broader financial infrastructure provider beyond insurance. This product expansion opens new revenue streams and user engagement opportunities as founders manage more financial needs on a single platform.

“Corgi has diversified offerings beyond insurance, including payments and a publicly traded ETF through Corgi Funds”

Corgi implements encryption, firewalls, and SSL technology alongside compliance and regulatory infrastructure to protect user data. While acknowledging that no security measures guarantee absolute protection, this foundation is necessary to support enterprise adoption and retention.

“Company implements encryption, firewalls, and secure socket layer technology but acknowledges these measures do not guarantee protection against all breaches”

Corgi's $630M valuation, $108M in Seed and Series A funding, and backing from Y Combinator and top-tier VCs signal strong institutional confidence in the startup insurance market and the company's ability to execute. This financial runway supports continued product expansion and go-to-market investment.

“Corgi's valuation reached $630M following the fundraise”

Corgi's Pre-Seed, Seed, Series A, and Growth packages allow founders to toggle coverage as their company evolves, avoiding over-insurance costs early or under-insurance risks later. This staged approach reduces founder decision fatigue and ensures coverage tracks actual liability exposure at each growth phase.

“Modular coverage design allowing startups to toggle coverage modules as they grow from MVP to IPO”

Corgi's pricing is approximately 10x lower than traditional brokers, making insurance accessible to early-stage startups that would otherwise defer or skip coverage. This cost advantage is particularly impactful for pre-seed and seed founders managing tight budgets and competing priorities.

“Corgi delivered a quote at one-tenth the cost of a traditional broker, with zero back-and-forth. We got our certificate of insurance immediately and kept the deal moving.”

Corgi offers specialized insurance tailored to AI, Fintech, Marketplaces, Health-tech, and SaaS verticals, reflecting that traditional insurance underwriters do not understand modern software risk profiles like uptime, API failures, or digital operational resilience. This vertical focus improves relevance and underwriting accuracy for high-growth tech.

“Traditional business insurance doesn't understand SaaS-specific risks like uptime, API calls, and digital operational failures”

Corgi's full-stack AI insurance carrier model automates quoting, underwriting, and issuance at scale, removing manual bottlenecks inherent in traditional insurance operations. This technology foundation underpins the speed and cost advantages that define the user experience.

“Corgi positioned as the world's first AI-insurance company”

Corgi's core value proposition—instant quotes, immediate Certificate of Insurance issuance, and minutes-long setup—directly enables founders to close enterprise contracts and meet hard compliance requirements (SOC 2, COI mandates) that would otherwise block 7-figure deals. This speed advantage directly drives user engagement by removing bottlenecks that traditional brokers create over days or weeks.

“Corgi is positioning itself as building 'the fastest business insurance, ever' with a fast-paced approach to insurance delivery”

AI founders face unique liability exposures—algorithmic bias, LLM hallucinations causing defamatory content, training data IP disputes, and autonomous system failures—that traditional Tech E&O policies do not cover. Enterprise buyers and VCs increasingly require AI risk management proof, creating demand for specialized AI liability coverage that Corgi uniquely offers.

“LLM hallucinations causing false, defamatory, or harmful information that triggers third-party losses”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.